Four out of the eleven blocks on offer in the Santos and Campos Basins offshore Brazil, were acquired as part of Brazil's first cycle of the Open Acreage in the production-sharing model (OPP), held Friday by the country's oil and gas regulator, ANP.

The bid round attracted R$ 916,252,000.00 (around $171,9 million) in signature bonuses (72% of the maximum possible). In addition, R$ 1.44 billion (around $270,1 million) in investments by the winning companies are estimated in the first phase of the contracts alone (exploration phase).

The winners include the likes of TotalEnergies, BP, Qatar Energy, Petronas, Petrobras, BP, and Shell.

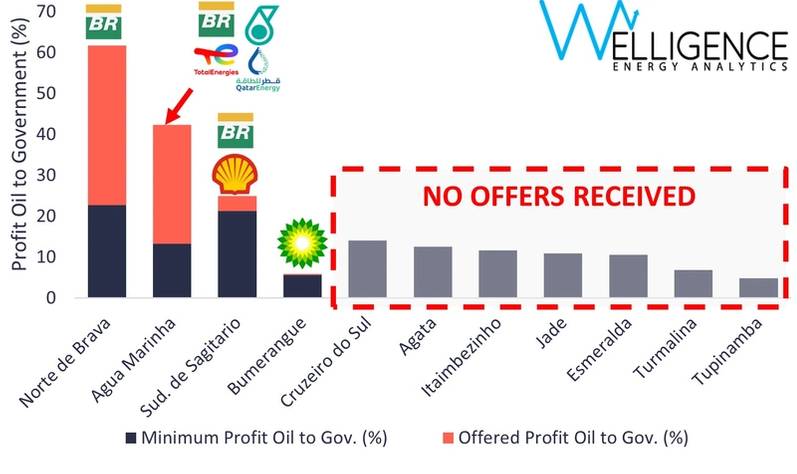

Describing the bidding round results, offshore oil and gas intelligence company Welligence said: “The first PSC Permanent Offer round was held today, with 4 of the 11 blocks on offer in the Santos and Campos basins awarded. The involvement of large international companies is encouraging, but most of the acreage awarded was lower risk, including areas with extensions of existing discoveries. This reflects the sector reluctance to engage in high-risk exploration, and the underwhelming results of recent pre-salt exploration – the ANP may need to continue refining its terms.

"Unsurprisingly, Petrobras picked up the most blocks with 3. The company took Norte de Brava by itself, partnered with Shell to take Sudoeste de Sagitario, and had to exercise its preferential rights to join the TotalEnergies / QatarEnergy / PETRONAS consortium, which outbid it for Agua Marinha. The most notable winner was bp, which picked up Bumerangue, the highest risk award of the round," Welligence said. ©Welligence

©Welligence

ANP Director-General Rodolfo Saboia said: "Today we had a good result for Brazil. The amount collected in signature bonuses represents 72% of the maximum that could have been collected if all areas had been acquired. With this, we guarantee minimum investments of R$ 1.44 billion, which will result in economic activity, jobs and income for Brazilians. This shows that the areas with the greatest potential were the object of interest for oil and gas exploration and production companies,” said

He also highlighted the fact that two of the areas, Água Marinha and Norte de Brava, had competition: "In Água Marinha, the minimum percentage of profit-oil was exceeded by 220% and, in the case of Norte de Brava, the percentage offered had a premium of almost 171.73% in relation to the minimum. With this, we guarantee more resources for the Brazilian society in the long term as well, through greater collection on the profit from oil production resulting from the bid."

As in all rounds in the production-sharing regime, in this one the signature bonuses (amount paid in cash by companies who acquire areas in the bid) were fixed and provided for in the tender protocol.

Thus, the criterion for choosing the winning companies was the profit oil for the Federal State. The tender protocol established a minimum percentage of profit oil, from which the companies made their offers, ANP explained.

The profit oil is the portion of the oil and/or natural gas production to be shared between the Federal State and the contracted company, according to criteria defined in the contract, resulting from the difference between the total volume of production and the installments corresponding to the royalties due and the cost oil (portion of the production corresponding to the company's operating costs and investments in the field).

TotalEnergies: Expanding Presence in High-potential, Low-cost Basin

As mentioned earlier, TotalEnergies, and its co-venturers QatarEnergy and Petronas have won the Agua Marinha block.

Agua Marinha is a large block of 1,300 km2, about 140 km from onshore, located in the pre-salt Campos Basin.

“TotalEnergies is pleased to expand its presence in the Campos Basin with this new exploration block, alongside three strategic partners. This is in line with our strategy to focus exploration on selected high potential basins which can deliver material low cost, low carbon intensity resources,” said Kevin McLachlan, Senior Vice President, Exploration of TotalEnergies.

TotalEnergies will participate in the block with a 30% interest, alongside Petrobras operator (30%), QatarEnergy (20%) and PPBL (20%).

The entry into this block follows the entry into 2 blocks, S-M-1815 and S-M-1711, in the South Santos basin during the 3rd Cycle of the Permanent offer that took place on April 13, 2022.

Bidding Round Results:

Basin | Sector | Block | Winning Company / Consortium | Signature bonus (fixed value) | Percentage of oil for the Federal State | Premium |

Campos | SC-AP4 | Água Marinha | Petrobras (30%)*; TotalEnergies EP (30%); Petronas (20%); QatarEnergy (20%) | 65,443,000.00 | 42.40% | 220.48% |

Campos | SC-AP2 | Norte de Brava | Petrobras (100%)* | 511,692,000.00 | 61.71% | 171.73% |

Santos | SS-AUP5 | Bumerangue | BP Energy (100%)* | 8,861,000.00 | 5.90% | 4.24% |

Santos | SS-AP2 | Sudoeste de Sagitário | Petrobras (60%)*; Shell Brasil (40%) | 330,256,000.00 | 25.00% | 17.37% |