The U.S. government on Friday received just a single bid, from Hilcorp Alaska, for oil and gas drilling rights off the coast of Alaska the first federal auction in the region in more than five years.

The offer of nearly 1 million acres in the Cook Inlet was among the concessions to the oil and gas sector included in President Joe Biden's signature climate change law, the Inflation Reduction Act (IRA).

Under the law, the Interior Department is required to hold the sale by Dec. 31. The agency had scrapped the Cook Inlet sale earlier this year before the IRA passed, citing a lack of industry interest.

Hilcorp Alaska is a unit of Hilcorp Energy LP, the largest privately owned U.S. energy producer. The Texas based independent exploration and production (E and P) company invests in legacy assets.

The Interior Department's Bureau of Ocean Energy Management (BOEM) announced that Hilcorp offered the only bid for a block offered on Friday for $63,983. BOEM oversees offshore energy development for the Interior Department.

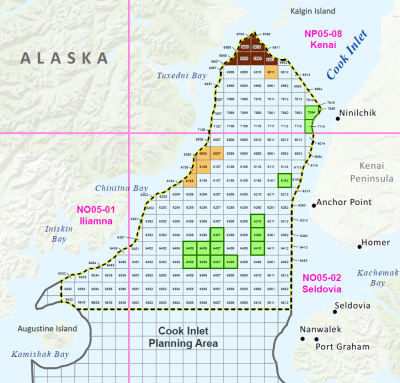

BOEM had offered 193 blocks covering about 958,202 acres (387,771 hecatres). Cook Inlet stretches 180 miles (290 km) from Anchorage to the Gulf of Alaska.

(Image: BOEM)

(Image: BOEM)

Last week, five environmental groups sued the administration to block the sale, alleging it had not adequately considered the auction's impact on climate change as well as the consequences for threatened species such as the Cook Inlet beluga whale and humpback whales.

"This damaging sale never should have happened in the first place, and we’ll continue challenging it in court and fighting to preserve beautiful Cook Inlet," said Kristen Monsell, oceans legal director at the Center for Biological Diversity, said on Friday.

The federal government has held several oil and gas lease sales in the Cook Inlet since the 1970s, but no production has occurred in federal waters there to date. There are 14 active federal leases in Cook Inlet, all of which were purchased by Houston-based Hilcorp at the last federal auction in the region in 2017.

Operating oil and gas platforms in the area are all in state waters, but oil production has declined substantially since peaking in the 1970s.

The areas offered for leasing have the potential to produce 192.3 million barrels of oil and 301.9 billion cubic feet of natural gas, according to an Interior Department estimate.

Following Friday's sale, there will be a 90-day evaluation process to ensure the taxpayer fair market value before a lease is awarded.

(Reuters - Reporting by Nichola Groom and Valerie Volcovici; editing by Barbara Lewis and David Gregorio)