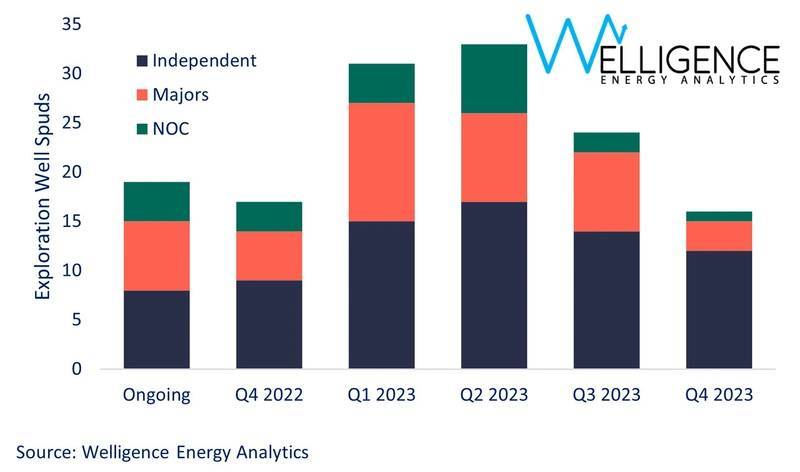

Welligence expects global offshore exploration drilling activity in 2023 to remain relatively steady year-on-year. The majors will drive much of the activity in their core regions, along with Petrobras, the world’s leading deepwater operator.

And while there are far fewer independents active in the offshore today compared to 10 years ago, Welligence still anticipates over 30 members of the peer group to operate exploration wells.

Two areas with big impact potential will draw much of the exploration investment – the Atlantic Basin and the Eastern Mediterranean.

Most companies will chase oil, but gas is the primary target in the latter region. Indeed, with FLNG starting to build momentum as a development solution, gas is an increasingly appealing option. Furthermore, new plays offer large discovery potential – these finds benefit from economies of scale and operation, making them very attractive not just under standard economic metrics, but also greenhouse gas emission metrics, an increasingly important criteria for the sector.

Both sides of the basin will host much of the action. The world-class success achieved by Shell (Graff) and TotalEnergies (Venus) earlier this year has unlocked Namibia’s Orange Basin, and it will see multiple wells in 2023, including an effort (the 5/6/7-1x well) by the French Major to extend the play into South Africa.

Equinor is looking to replicate the success on the conjugate margin in Argentina – all eyes will be on its US$100 million Argerich-1 well in the Argentina Basin, whose geology is considered analogous to the Orange Basin; success would open a new production frontier for the country.

The Equatorial Margin off South America’s northeast coast will continue to attract significant exploration dollars.

The highest risk effort will be undertaken by Petrobras, which plans to spend US$3 billion over the next five years in an effort to prove up Brazil’s Equatorial Margin basins. The spud of its Morpho well in the Foz do Amazonas Basin is imminent, with three additional targets to follow.

In Guyana, expect to see ExxonMobil add more resource to the 11 bnboe+ already found at the Stabroek block, while TotalEnergies continues to try to prove up the commerciality of Block 58 in Suriname. The big question, however, is whether anyone else can make meaningful finds in the Guyana Basin.

Source: Welligence Energy Analytics

Moving further up the coast to eastern Canada, bp is preparing to spud the Ephesus prospect in the under-explored Orphan Basin. This is a giant, billion-barrel target.

Welligence’s second exploration hotspot is the Eastern Mediterranean, which has already yielded multi-Tcf gas discoveries and is producing significant volumes.

With existing infrastructure in place or planned, and a ready market in Europe, this is one region where gas definitely works.

Top explorer Eni will be highly active – it just spudded the Thuraya-1 well offshore Egypt, and is drilling ahead at the Zeus prospect in Cyprus.

In Egypt, BP has secured a rig to kick off a four-well program. In Lebanon, TotalEnergies will drill the country’s second-ever well offshore with Qana-1.

Outwith the two areas highlighted, there is plenty of high impact activity planned.

Eni will explore for gas offshore Morocco at its Tarfaya block, plus attempt to open a new oil play in Mozambique with its Raia-1 well.

In Asia Pacific, TotalEnergies is drilling ahead at Tepat North prospect offshore Sabah Malaysia, targeting the Oligo-Miocene trend opened by its Tepat find in 2018. In Indonesia, Eni will drill Geng North, while Harbour Energy will look to prove up additional resource on its Andaman II block, where it made the Timpan discovery earlier this year.

Exploration will continue in more established areas.

In the mature North Sea and US Gulf of Mexico, the independents will drive most activity, targeting prospects in established plays that are typically within tieback distance to existing infrastructure.

Some new play exploration is planned, however, such as Aker BP’s Rondeslottet well in Norway. And despite underwhelming results in recent years, the larger companies will continue to explore Brazil’s pre-salt, with Shell, PETRONAS and bp potentially drilling.

This article was originally published in the November/December 2022 edition of Offshore Engineer Magazine: