Over the last few weeks, we have seen three announcements by Chinese OEMs of 18-megawatt (MW) turbines.

CSSC Haizhuang announced the H260-18MW turbine with a 260-meter rotor diameter. Mingyang Smart Energy has announced its new MySE 18X-28X turbine, which has a rotor diameter of over 280 meters.

Dongfang is developing 16-, 17- and 18-MW turbines featuring rotor diameters of over 160 meters and 128-meter-long blades.

We expect these turbines to be aimed at both the Chinese domestic market as well as projects in Europe, Asia and possibly the U.S.

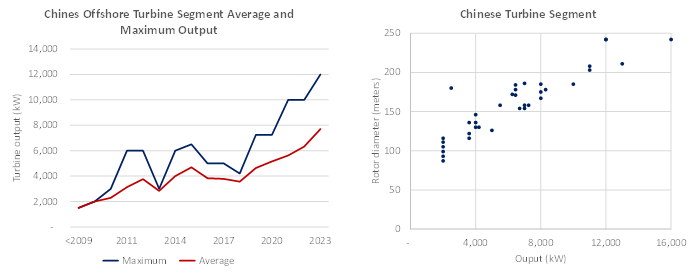

As we see from the chart below, these new turbines are significantly larger than the average size of turbines currently deployed on Chinese projects, where the average turbine output deployed on projects commissioned in 2023 is expected to be 8 MW.

The largest rotor diameter for an 8-MW turbine deployed in China is around 185 meters, far smaller than the new 18-MW units.

(Source: Intelatus Global Partners)

(Source: Intelatus Global Partners)

At the same time, China’s factories have produced some of the world’s largest monopiles. ZPMC has produced 2,200-tonne monopiles of 9.6-meter outside diameter. Nantong Rainbow is also reported to have manufactured a 2,294-tonne monopile with a diameter of 10.3 meters.

Daijin is planning a new factory in South China capable of manufacturing 3,500-tonne monopiles of up to 15-meter diameters. The drivers for these large monopiles are not only turbine size and increased water depths but also poor soils, especially closer to the surface.

On the vessel supply side, there are currently 36 Chinese active, optimal newbuild wind turbine installation vessels (WTIV) and floating wind foundation installation vessels (FIV) and barges. We define optimal as capable of installing the foundations for 8- to 10-MW turbines. Of these 36 vessels, fives are candidates for 15- or 16-MW turbine installation, but not 18-MW turbine installation.

We forecast a demand for around 10 large turbine and foundation installation vessels in the Chinese market through this decade, pointing to a shortage of five to 10 vessels.

In the international segment, the supply side for vessels capable of installing 18-MW turbines will grow to nine by around the middle of the decade. As we have discussed in our wind farm installation vessel forecast, there will be some supply shortages in the large international wind turbine and foundation installation segment through this decade.

For more information about the Intelatus Global Partners, visit www.intelatus.com or contact Philip Lewis at +44 203-966-2492.