Rig activity stood out in several regions in 2022, and there is no reason to expect anything different in 2023, Westwood Energy's Terry Childs writes.

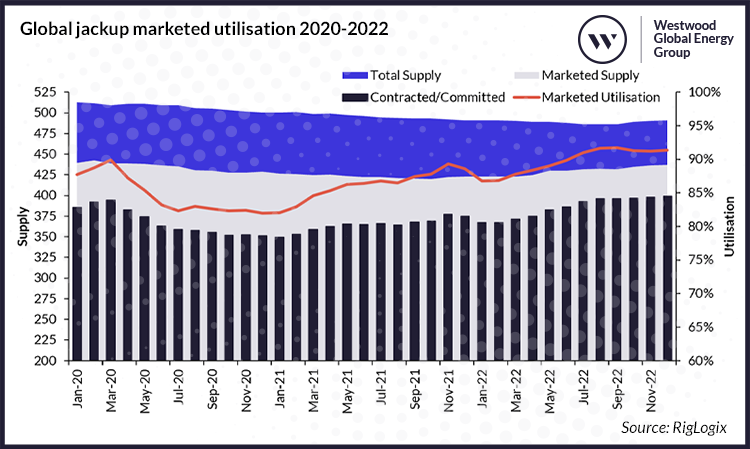

In 2022, offshore rig activity for both jack-ups and floating rigs was robust in several key regions of the world. Global marketed jack-up utilization increased from 87% in January to 91% in December.

In January, 367 of 423 marketed units were contracted or committed for work, while in December, the numbers increased to 398 of 437 marketed units contracted or committed for work. From July through December, utilization was above 90%.

The Middle East garnered all the jack-up attention last year, and for good reason. Major rig fleet growth for Advanced Energy Systems (ADES) and Arabian Drilling, coupled with over 60 new contract awards from Saudi Aramco and ADNOC Offshore, resulted in a substantial number of long idled and stranded newbuild jack-ups finding work in the form of a minimum of three to five-year contracts, most of which will commence this year. In addition, several currently working units were signed to similar multi-year extensions.

In addition to the Middle East, state-run operators ONGC in India, Pemex in Mexico, and CNOOC in China extended contracts for those jack-ups already working in those regions. In fact, the number of jack-ups working offshore accounts for the second most in the world, behind the Middle East.

Meanwhile, jack-up utilization in the North Sea increased by 18% between January and October of last year, hitting 97% before the typical winter decline late in the year. Lastly, Southeast Asia saw a 2022 rebound as well. Despite a late year drop, marketed utilization was up by 14% for the year, ending at 88% in December.

As would be expected, jack-up dayrates have increased in every geographic area, with most growing by double digits. In the Middle East, rates for new fixtures eclipsed $100,000 late in the year, while several deals were done in the $78,000-$85,000 range earlier in 2022.  The Middle East garnered all the jack-up attention in 2022 ©Lukasz Z/AdobeStock

The Middle East garnered all the jack-up attention in 2022 ©Lukasz Z/AdobeStock

Similarly, in Southeast Asia, rates in early 2022 were generally fixed in the mid $70,000s, but by the end of the year were as high as $134,000, with several others over $100,000. Dayrates in the North Sea took the same path, ranging from $75,000-$85,000 in early 2022 to almost $137,000 for a fixture in December.

For 2023, Westwood expects jack-up utilization to remain robust. There will likely be additional contract awards in the Middle East, albeit probably not at the same pace as seen in 2022. In addition, outstanding rig requirements in Southeast Asia and West Africa will help result in a continued tight supply/demand balance in those regions. Contract extensions currently taking place in Mexico will keep utilization there robust.

However, activity in the North Sea, another area where marketed jack-up utilization was above 90% for at least half of 2022, is a bit questionable.

The 2022-implemented UK windfall tax has several operators reconsidering previously planned drilling programs, and some have already indicated they will cancel specific campaigns. As a result, some rig owners have begun marketing jack-ups into other regions, making it probable that additional rigs will leave the area this year.

Despite the potential North Sea issues, global marketed utilization is believed to increase from the 90% average in 2022 to around 95% this year. Given that level of utilization, rig owners will undoubtedly continue to push dayrates upward.

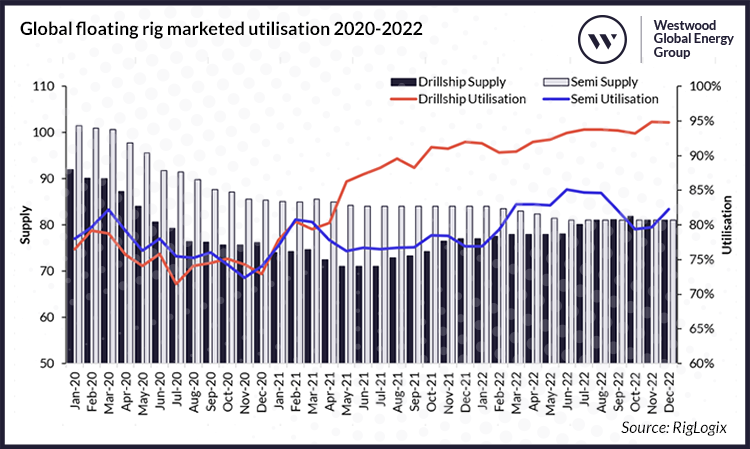

For the floating rig fleet – semi-submersibles (semis) and drillships – marketed utilization ranged from 80% to 90% for all of 2022, settling just under the latter in December. However, there was a stark difference between the two rig types; drillship utilization averaged 93% for the year, while average semi-submersible rig utilization was some 11% lower, at 82%. Nevertheless, for the year, overall demand increased from 135 units in January to 143 in December, while marketed supply increased by a net of one, ending the year at 162.

Rig demand rose in several regions, with the US Gulf of Mexico and South America both standing out. In the US Gulf, marketed utilization was 100% from February through December, while South America marketed utilization ranged from 94% to 97% for the entire year.

Elsewhere, marketed drillship utilization in Africa increased by 10% in 2022, although it was not accomplished by rising demand. For the year, marketed supply declined by three units and demand fell by one, resulting in higher utilization.

On the opposite end of the scale, marketed utilization in Southeast Asia fell by 16% for the year. However, the average number of contracted/committed units dropped by just two units, while the average marketed supply declined by just under one. Finally, marketed semi-submersible drilling rig utilization in the North Sea saw a slight improvement last year, with marketed utilization going from 77% in January to 81% in December. Supply was relatively unchanged, and demand increased by just one during the year.

Rig reactivations for long-idled, cold-stacked units, mostly drillships, began in 2021 and continued last year. As a result, the average drillship marketed supply increased by four. On the other hand, the average net semi-submersible drilling rigs marketed supply fell by three, although that decline was the smallest in the past 7-8 years. Only six semis were retired in 2022, compared to 142 from 2014-2021, an average of nearly 18 per year. No drillships were removed from the fleet last year.

During the year, 94 of 131 contract awards (mutually agreed new contracts and options) were for work in the North Sea and the so-called golden triangle, which is the Gulf of Mexico (US and Mexico), South America, and West Africa. Elsewhere, the Far East, Southeast Asia, and Australia combined for another 28 fixtures.

Dayrates for new drillship fixtures in 2022 were substantially improved from the prior year. After an average fixture rate of $232,555 in 2021, the number jumped to $359,852 in 2022, and for the final four months of the year the average increased to $388,842. As has been reported, a number of deals in 2022 were fixed at over $400,000, with the highest reaching $462,000 for a contract offshore Brazil. Regionally, the US Gulf of Mexico and South America were the trendsetters in the rate increases. For semi-submersible drilling rigs, there were 74 new fixtures in 2022 - ©Denys Yelmanov/AdobeStock

For semi-submersible drilling rigs, there were 74 new fixtures in 2022 - ©Denys Yelmanov/AdobeStock

For semi-submersible drilling rigs, there were 74 new fixtures in 2022. While rates early in the year (excluding the North Sea) were generally in the $200,000-$250,000 range, by August they were routinely over $300,000, with one in Brazil eclipsing $400,000. However, late in the year, there were two awards for work in Brazil that fell back to the $245,000-$290,000 range, but both were for workover-only programs. During the year, there were, of course, outliers on both ends, with some Southeast Asia fixtures well below the rest of the market.

In 2023, there is no reason to believe the focus will not be in the same regions. Outstanding rig requirements will result in continued rig demand for exploration drilling, with long-term field development programs also adding multi-year contracts. There are currently 73 rig requirements globally that are in some form of rig inquiry. The golden triangle area accounts for 23 of these, while the North Sea totals 16. Another 21 requirements are on the books in Southeast Asia, the Far East and Australia, and operators are looking for rigs for 10 programs in the Mediterranean/Black Sea area.

Currently, 83 of the 162 active floating rigs have no availability in 2023. Of the remaining 64 contracted units with a 2023 available date, 28 run until November or December. Twelve of the 64 have options that, if exercised, will extend availability into 2024 or later.

We could go on, but the numbers are evidence of a rig fleet with decreasing availability in 2023. To that end, most recent floating rig tenders have specified a 2024 start date, but there are some limited windows of opportunity for operators in some regions that have just one or two wells to drill.

Looking out for the remainder of 2023, marketed drillship supply and demand will remain tight and utilization will continue in the 95% plus region. Rig demand in the golden triangle will keep the fleets currently working there and some incremental demand will be created. In addition, areas like the Mediterranean, where recent large discoveries have been made, could push some more drilling plans forward.

Semi-submersible drilling rig usage will continue to be prominent in the North Sea, although the same issue noted for jack-ups, that is operators deciding not to pursue some drilling plans due to the UK windfall tax, could have a negative impact. Westwood also expects activity in Norway to rebound from disappointing 2022 levels in the second half of the year. Elsewhere, utilization in South America will remain at or near 100%, and we believe increases in activity will take place in Southeast Asia and Australia. For the year, global marketed semi-submersible drilling rig utilization is projected to average 94%.

The current trajectory of dayrates will continue their upward path, but whether that will be maintained at a similar pace as in 2022 remains to be seen. Most questions surrounding floating rig dayrates are centered around when they will reach $500,000, particularly for drillships.

Anecdotal evidence suggests that bids at that rate have already been submitted, but so far, no awards have been made. The number could be reached in the form of a multi-year deal where $500,000 comes after the first year. However, any way one looks at it, 2023 should be a busy year for rigs.

Author:

Terry Childs is the Head of RigLogix by Westwood Global Energy Group and is responsible for leading the research and insights into the worldwide offshore rig market.

Republished with permission. The article above was originally published on Westwood Global Energy Group website under the title:"Global marketed offshore rig utilization to average 95% in 2023."