The Australian offshore oil and gas company Carnarvon Energy said Wednesday that it would sell a 10% interest in each of its Bedout Basin offshore blocks, including in the Dorado offshore oil field, off Western Australia, to a subsidiary of Taiwan’s national oil and gas company, CPC.

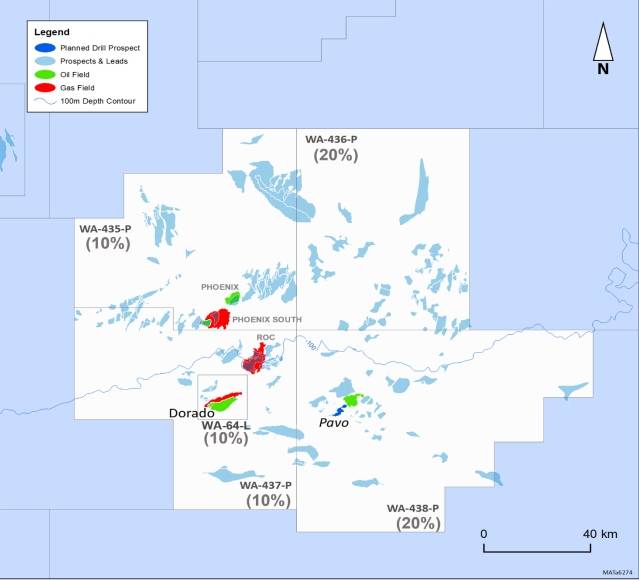

Carnarvon’s Bedout assets consist of the WA-64-L Production Licence (containing the Dorado field), and the WA-435-P, WA-436-P, WA-437-P and WA-438-P Exploration Permits.

Dorado is one of the largest offshore oil discoveries in W. Australia, and Carnarvon, with operator Santos, has been working to reach a final investment decision to proceed with the field development.

Under the deal with CPC, Carnarvon will receive total cash consideration of $146 million from the divestment.

The consideration comprises an upfront payment of $56 million on completion of the transaction, and a further carry of $90 million of Carnarvon’s forward expenditure in the Bedout permits once a final investment decision (FID) is taken on the Dorado development.

"The proceeds from the divestment, together with prospective debt finance and Carnarvon’s existing cash, will be used to fund Carnarvon’s share of the Dorado development costs along with further activities that include exploration in the Bedout Sub-basin and appraisal of the recent Pavo discovery," Carnarvon said.

Carnarvon retains 20% of the Pavo discovery and follow-up potential in the WA-438-P Exploration Permit post divestment.

Carnarvon’s equity in the Bedout permits currently, and following completion, are below:

| Permit | Current | Following completion |

| WA-64-L | 20% | 10% |

| WA-435-P | 20% | 10% |

| WA-436-P | 30% | 20% |

| WA-437-P | 20% | 10% |

| WA-438-P | 30% | 20% |

"Carnarvon continues to progress its targeted debt financing process. To date, there has been a strong level of market interest across all the potential funding sources for the Dorado development," the company said.

The company said hit had been been progressing a broad range of potential sources of capital to part fund its share of the Dorado development.

These include traditional reserve-based, non-recourse senior debt facilities; and alternative funding options (including junior or subordinated debt, offtake prepayment and royalties).

"Carnarvon has received a strong level of market interest across all these sources of capital and will continue to progress these to deliver the optimal balance of capital management while maximising risk-weighted value for shareholders," the company said. Carnarvon Energy's Bedout Assets - ©Carnarvon Energy

Carnarvon Energy's Bedout Assets - ©Carnarvon Energy

Commenting on the agreement with CPC, Carnarvon Managing Director and CEO, Adrian Cook, said:"CPC’s status as a leading national oil and gas company in the Asian region, combined with its appetite for this transaction, clearly demonstrate the world-class nature of the Dorado development and the greater Bedout Sub-basin.

"We are delighted CPC will become a partner in the joint venture and look forward to working with them, and the operator to prepare Dorado for FID. Following completion of the transaction, Carnarvon will be in the enviable position of holding substantial cash and financial liquidity to fund its share of the world class Dorado development.

Following completion, Carnarvon will hold a pro-forma cash balance of approximately 178 million Australian dollars (currently around 121,6 million U.S. dollars).

"This strong financial position is also expected to support the advancement of low risk growth through the appraisal and development of the nearby Pavo discovery, and pursuing extensive upside potential via exploration opportunities in the Bedout Sub-basin of the highest quality.”

Azure Capital acted as Carnarvon’s adviser on the transaction, as well as advising on its ongoing debt financing process for the Dorado development.

Offshore Project Proposal

Earlier this month, the Australian offshore oil and gas safety regulator NOPSEMA accepted Santos' Offshore Project Proposal (OPP) relating to the Dorado project.

"Acceptance of the OPP is an important progression in the regulatory approval process to support the sanctioning of the Dorado development," Carnarvon Energy said at the time.

Santos is working to develop the Dorado using an FPSO and a wellhead platform.

The accepted OPP covers approval to undertake the Dorado Phase 1 liquids development, including the reinjection of gas to enhance resource recovery, as well as tie back future resources within the ‘project area’ covered by the OPP to boost Dorado production.

This means that nearby resources, like the recently discovered Pavo field, can potentially be tied back and produced using the Dorado floating, production, storage, and offloading vessel, Carnarvon explained.