A final investment decision for the long-stalled Sea Lion development offshore the Falkland Islands could be reached in 2024, Rockhopper, a partner in the project, said Friday, after Navitas Petroleum, the project operator, presented it with an updated development plan.

Navitas Petroleum last year agreed to farm into the Sea Lion oil field development project and acquired the previous project operator Premier Oil from Harbour Energy.

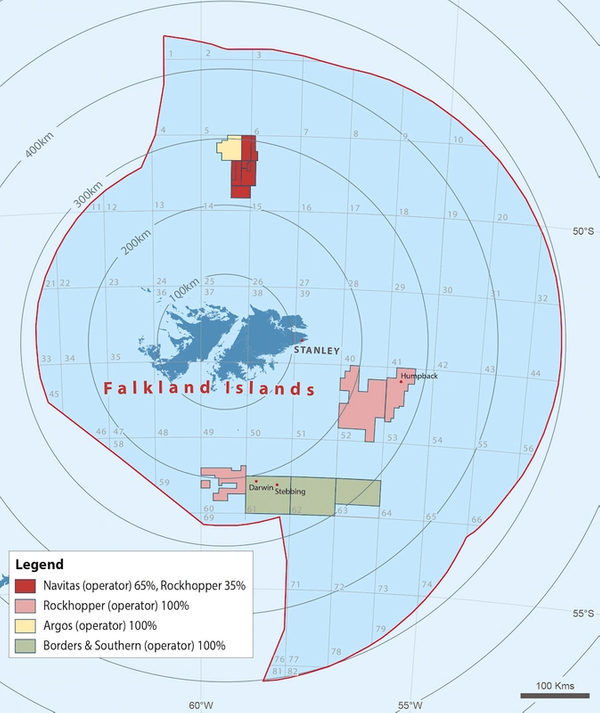

Rockhopper, which discovered the Sea Lion back in 2010, said in April last year that it would, together with Navitas, seek to align working interests across all their North Falkland Basin petroleum licenses so that Rockhopper would own 35% and Navitas 65%, and that the two companies would jointly develop and agree on a technical and financing plan to enable the development of the Sea Lion project to achieve first oil on a lower cost and expedited basis post-sanction.

Sea Lion and its satellite fields were previously estimated to hold around 520 mmbbls of 2C Contingent Resources.

However, Rockhopper said Friday that Navitas had recently released an update which included an independent resource report conducted by Netherland Sewell & Associates (“NSAI”) (the “NSAI Independent Report”), showing reduced upfront capex, reduced life of field costs, and increased recoverable resources.

The new development plan, which Navitas continues to optimize and is subject to change, adopts a staged approach and, according to Rockhopper, represents a material reduction in both upfront and life of field cost when compared to the previous development scheme, while still achieving a plateau production rate in the initial stage of approximately 80,000 bbls/d, a peak production rate of approximately 100,000 bbls/d and recovery of over 269 MMbbls of oil (2C Development Pending) out of 712 MMbbls (2C Total).

The new development plan proposes 18 wells to be drilled in the first phase, 11 of these coming before first oil. The phase 2 drilling campaign will add a further five wells approximately 42 months after first oil. Those later wells will also be tied into the FPSO to extend the production plateau.

"Having successfully re-defined the project, work will now focus on refining the financing plan with a view to reaching FID during 2024. In the meantime, technical work streams continue to further refine the project, with Navitas focused on driving further project optimizations. Based on a redeployed FPSO, a timeline of 30 months is envisaged from FID to first oil, with drilling anticipated to commence approximately 12 months post FID,2 Rockhopper said.

As previously disclosed, Rockhopper believed it was possible to materially reduce pre-first oil capex from the previously estimated US$1.8 billion (assuming a leased FPSO) and overall project capex by taking actions such as reducing the number of wells drilled pre first oil and reducing the number of drill centres.

The last independent resource report commissioned directly by Rockhopper was the ERCE 2016 Report which had an estimated 2C value of 517 MMbbls. The Navitas commissioned NSAI Independent Report used an updated approach and assumptions to the ERCE 2016 report.

Highlights of Navitas' Sea Lion plans and estimates, assuming a leased FPSO and a 100% working interest, as shared by Rockhopper:

Sea Lion Phase 1 and 2 Development

2C Contingent Resources (Development Pending) phase 1 and 2 development concept

Per barrel cost – life of field

The NSAI Independent Report on Sea Lion resource estimates:

1C (MMbbls) | 2C (MMbbls) | 3C (MMbbls) | |

Development Pending | 204 | 269 | 368 |

Development Unclarified | 247 | 443 | 761 |

Total | 451 | 712 | 1,129 |

The Development Pending category designates 269 MMbbls 2C to be developed in two phases.

The Development Unclarified category of 443 MMbbls 2C are the additional resources contained on the North Falkland Basin held by Navitas and Rockhopper, including Sea Lion and Isobel/Elaine, that could be developed under future phases but for which there is currently no published development plan.

According to RockHopper, the NSAI Independent Report contains analysis of cash flows and NPV on the phase 1 and 2 development net to Navitas. Based on the NSAI Independent Report data, the joint venture NPV10 of the development of 269 MMbbls is US$4.3 billion on a post royalty and pre-tax basis, at US$77 Brent.