Viaro Energy's subsidiary RockRose Energy has struck a farm-in agreement with Hartshead Resources, to acquire a 60% working interest in Production Licence P.2607 containing the Anning and Somerville fields in the UK North Sea.

Hartshead will retain a 40% working interest in the offshore license.

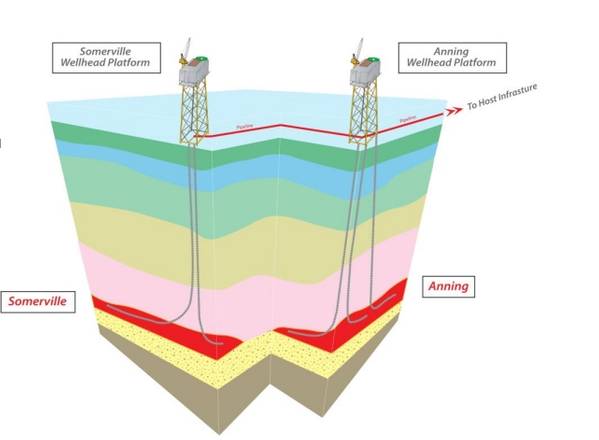

The project is a phased redevelopment of gas fields located in the Southern Gas Basin.

Phase 1 will see the development of the Anning and Somerville fields, and Phase 2 will focus on the Hodgkin and Lovelace fields.

Anning and Somerville were both originally discovered in 1969, with Somerville coming onstream in 1999 and Anning in 2008. The fields ceased production in 2015, at which point Somerville had produced 48 bcf of gas, and Anning had produced 16 bcf of gas.

"It is expected that a Final Investment Decision (“FID”) will be taken in Q3 2023. Thereafter the joint redevelopment of the two fields envisages six production wells being drilled, with first gas expected in Q4 2024 and gross peak production rates of 120 mmcfd (net 72 mmcfd to RockRose, or 12,000 boepd) being achieved in 2025. Gross remaining 2P reserves for Anning and Somerville are reported at 301 bcf of recoverable gas (50 mmboe), with 181 bcf (30 mmboe) net to RockRose. Gross development costs are estimated to be £351m," Viaro Energy said in a statement on Wednesday.

The farm-in deal is structured as a firm consideration payable to Hartshead, and a partial carry of the Phase 1 development costs for the Anning and Somerville fields. A further consideration payable to Hartshead is contingent upon the FID for the development of Phase 2. Additionally, it has been agreed that Operatorship of the license will transfer to RockRose at a mutually agreed future date.

While Viaro did not go into details on the financials, Hartshead said that a total consideration to Hartshead was up to $128 million for Phase 1 and $5.9 million for Phase 2.

Francesco Mazzagatti, CEO of Viaro Energy, said:"The partnership with Hartshead is significant for Viaro because it marks a return to operatorship for our main subsidiary RockRose. After several years of careful investments, we continue to see great potential in the Southern Gas Basin, which has been one of the most important and longest-standing sources of gas in Europe. It is easy to discard mature fields, but there are significant opportunities that come with introducing new energy developments to traditional gas exploration.

"Anning and Somerville are expected to reach first gas in Q4 2024 and will contribute around 12,000 boepd to our existing production base of 25-30,000 boepd, taking us a step closer to our 100,000 boepd target.

"This deal further proves our commitment to growing our portfolio in the North Sea basin and to the energy security of the UK. It is the second deal we have announced in the first months of 2023, and we have more in the pipeline for this year. I am pleased to say that the performance of our assets appears to indicate that our strategy is sound and we look forward to working collaboratively with Hartshead to deliver the successful development of these fields.”