AFC Equity Investment has agreed to buy Aker Energy, a company working to develop the Pecan oil field offshore Ghana, from Aker Capital and The Resource Group TRG AS.

Aker today holds 50.79 percent of the shares in Aker Energy, and TRG holds 49.21 percent. AFC Equity Investment is owned by Africa Finance Corporation (“AFC”).

The management team of Aker Energy will remain unchanged and will work towards submission of the Plan of Development (“PoD”) for the Pecan field to Ghanaian authorities in April 2023, Aker said Friday.

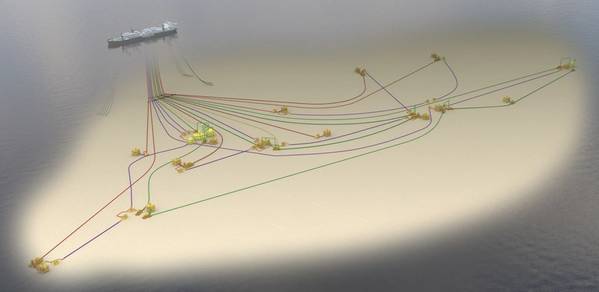

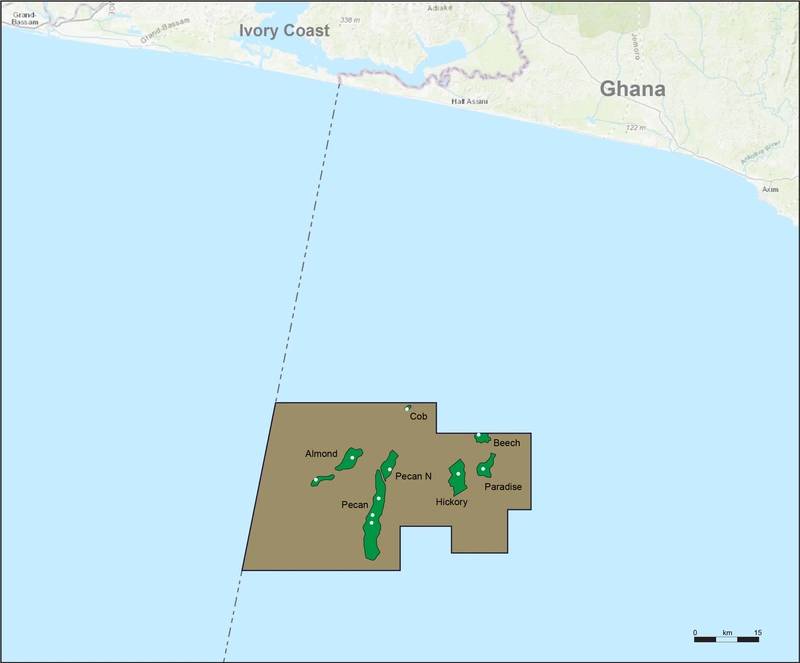

Through the transaction, AFC will become the sole shareholder of Aker Energy, and, thereby, 50 percent owner of the Deepwater Tano Cape Three Points (DWT/CTP) block offshore Ghana, comprising discoveries of 450-550 million barrels of oil equivalents, including the Pecan field.

Africa Finance Corporation has previously invested USD 200 million in senior secured bonds in the DWT/CTP block development, and AFC’s CEO currently serves on the Aker Energy board.

Øyvind Eriksen, President and CEO of Aker ASA said: “Aker still believes in the resource potential of the DWT/CTP block in Ghana. AFC is already invested in this field development and is well-positioned to continue this development.

In line with Aker's capital allocation priorities, we have thus made a strategic decision to sell our stake in the Ghana assets with an earn-out model as a consideration. This way we share the risk and reward of this future development.”

Licence Location - Credit: Aker Energy

“The sale to a reputable African institution, such as the AFC, was considered to be the best way forward to ensure the development of the Pecan field, as well as the whole DWT/CTP block. We are therefore very pleased to have reached this agreement with AFC.”

The consideration for the share purchase by AFC is an earn-out model based on potential future sales and/or production proceeds from the Pecan project. Aker will on an ongoing basis assess the value of the potential earn-out consideration compared to its current book value, which forms part of Aker’s Net Asset Value reporting.

“AFC reaffirms its commitment to catalyzing economic growth and development in Africa. AFC will continue to ensure that Africa’s natural resources, including its vast oil and gas reserves, are developed sustainably within the global framework on energy transition and the UN Sustainable Development Goals,” said Samaila Zubairu, President and CEO of AFC.

“The DWT/CTP Project, which aims to develop Ghana's proven resources, has the potential to create jobs, increase government revenues, and spur development in the country. Our continuing collaboration with Aker entities for technical support to the development will ensure that the PoD is submitted on time and in line with the framework agreed with the Government of Ghana. This is a positive step toward achieving the project's goals and significantly contributing value to the Ghanaian economy.”

In 2021, Aker Energy said it had, with its license partners, secured the FPSO Dhirubhai-1 for the first phase of the field development, and was working to submit a revised Plan of Development for the DWT/CTP block before the summer of 2022.

Aker Energy holds a 50% participating interest in the Deepwater Tano Cape Three Points block in Ghana, including the Pecan development project.

Other partners are Lukoil (38%), Fueltrade (2%) and Ghana National Petroleum Corporation (10%).

Reuters reported in February that Russia's Lukoil was in talks with Indian companies to sell its stake in the Pecan oilfield, which could help to break an impasse in submitting development plans for the field.