Higher shipbuilding costs are contributing to greater overall project costs in the U.S. offshore wind industry, according to maritime and offshore consultancy Intelatus Global Partners.

The United States will rely on a large fleet of foreign and domestic vessels as it builds up toward the Biden Administration's target of 30 gigawatts (GW) of offshore wind capacity by 2030 and 110 GW by 2050. This fleet will consist of both existing and newbuild tonnage, including wind turbine installation vessels (WTIV), subsea rock installation vessels, service operation vessels (SOV), crew transfer vessels (CTV) and tug and barge spreads, among others.

While vessels such as WTIVs can be foreign flagged and fed by domestic feedering solutions, others such as SOVs, CTVs and tugs will need to be built in the U.S. to comply with the Jones Act, which requires vessels transporting cargo between two U.S. points to be American-built, -owned, -registered and -crewed.

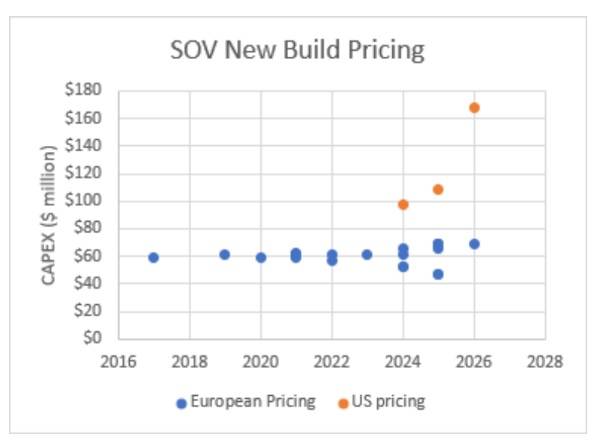

But the price to build these vessels in the U.S.—where labor costs are only expected to increase—is considerably higher than it is for those being built in Asia and Europe. According to Intelatus, the price for a newly built Jones Act-compliant SOV comes with a 40% to 140% premium compare to SOVs being built for Europe.

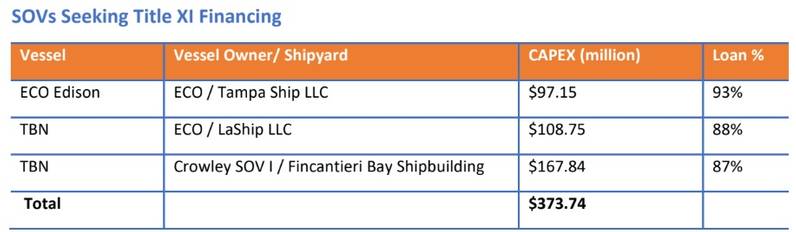

SOVs with applications currently pending for financing under the U.S. Maritime Administration's (MARAD) Title XI financing program. Intended to help facilitate more offshore wind vessel construction, Title XI provides credit loans at longer terms and lower interest rates than traditional private loans. (Source: Intelatus Global Partners interpretation of MARAD data)

SOVs with applications currently pending for financing under the U.S. Maritime Administration's (MARAD) Title XI financing program. Intended to help facilitate more offshore wind vessel construction, Title XI provides credit loans at longer terms and lower interest rates than traditional private loans. (Source: Intelatus Global Partners interpretation of MARAD data)

Price comparison of SOVs being built for the European and U.S. offshore wind industries. (Source: Intelatus Global Partners)

Price comparison of SOVs being built for the European and U.S. offshore wind industries. (Source: Intelatus Global Partners)

"[This] coincides with U.S. offshore wind projects such as South Fork and Vineyard Wind looking at project CAPEX of around $4,500 to $5,500 per kilowatt (kW), some 30% to 50% higher than those of European projects," Intelatus said.

The firm said heightened vessel pricing in the U.S. "will have a significant impact" when considering the quantity of required vessels as part of the bigger picture.

"To date, developer construction and operations plans and announcements indicate a market potential of more than 10 SOVs charted for long-term operations and maintenance support in the United States. Subject to clustering approaches analyzed in our reports, operator demand for SOVs is forecast to grow to significantly more than 20 units by 2035, with turbine manufacturers also chartering several SOVs."

While the U.S. federal government has put in place several programs to aid developers and their supply chain partners amid rising costs, Intelatus said there are still questions about their impacts.

For example, the Inflation Reduction Act of 2022 (IRA) contains a new 10% tax credit for the domestic production of offshore wind vessels. "We understand that the implementation is still being considered, and doubts remain about whether shipowners will see lower vessel pricing as a result of these tax incentives," Intelatus said.