The Australian offshore oil and gas company Carnarvon Energy is nearing completion of the divestment of a portion of its assets in the Bedout Basin, off Australia, with the closing of the transaction targeted for mid-year.

Carnarvon Energy in February entered into a binding agreement to divest a 10% interest in its Bedout assets to OPIC Australia Pty Limited, a wholly owned subsidiary of CPC Corporation, Taiwan (CPC), Taiwan’s national oil and gas company.

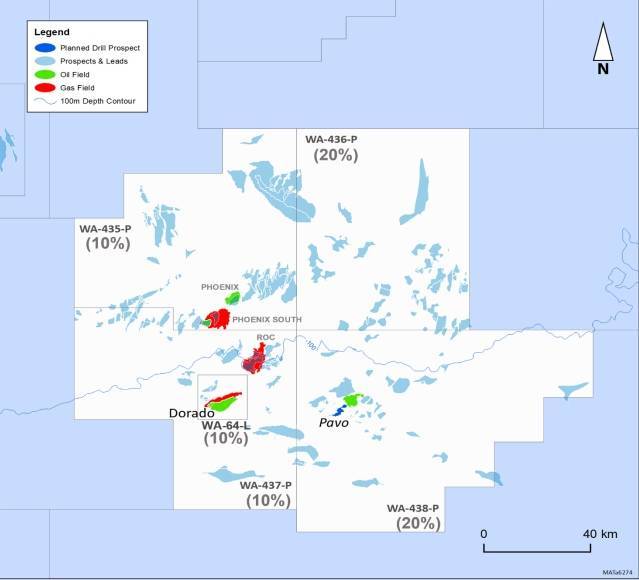

Carnarvon’s Bedout assets consist of the WA-64-L Production Licence (containing the Dorado field), and the WA-435-P, WA-436-P, WA-437-P and WA-438-P Exploration Permits.

Dorado is one of the largest offshore oil discoveries in W. Australia, and Carnarvon, with operator Santos, has been working to reach a final investment decision to proceed with the field development.

Under the divestment deal with OPIC Australia, Carnarvon will receive total cash consideration of US$146 million.

This comprises of an upfront payment of US$56 million (equivalent to ~A$80 million) on completion of the transaction, and a further carry of US$90 million (equivalent to ~A$129 million) towards Carnarvon’s share of the Dorado development costs once a Final Investment Decision (FID) is taken.  Carnarvon Energy's Bedout Assets - ©Carnarvon Energy

Carnarvon Energy's Bedout Assets - ©Carnarvon Energy

The transaction is subject to a number of customary conditions in respect of Joint Venture approval, approval by the Foreign Investment Review Board (FIRB) and approval and registration by the National Offshore Petroleum Titles Administrator (NOPTA).

"Carnarvon is pleased to advise that the majority of these conditions have now been satisfied, with the parties working diligently to achieve satisfaction of the final condition in a timely fashion. The parties are continuing to target completion of the transaction mid-year, subject to achievement of the final condition," Carnarvon Energy said Wednesday.

Carnarvon Managing Director and CEO, Adrian Cook, said: “I am extremely pleased with how the CPC transaction is progressing. Completion of this transaction is an important step in funding our share of the Dorado development. Following completion, Carnarvon will hold substantial cash and financial liquidity, enabling it to de-risk project funding in conjunction with prospective debt financing, which has received a strong level of market interest so far.

"Our team has been working closely with CPC since the start of this transaction and, along with the Operator [Santos], we are all aligned on progressing the Dorado development to FID as soon as possible.

"With the Offshore Project Proposal having also recently been accepted, the Joint Venture has all the primary regulatory approvals required to support development of Dorado, unlocking the significant value of this asset and the Bedout Sub-basin more broadly.”

Offshore Project Proposal

Back in February, the Australian offshore oil and gas safety regulator NOPSEMA accepted Santos' Offshore Project Proposal (OPP) relating to the Dorado project.

"Acceptance of the OPP is an important progression in the regulatory approval process to support the sanctioning of the Dorado development," Carnarvon Energy said at the time.

Santos is working to develop the Dorado using an FPSO and a wellhead platform.

The accepted OPP covers approval to undertake the Dorado Phase 1 liquids development, including the reinjection of gas to enhance resource recovery, as well as tie back future resources within the ‘project area’ covered by the OPP to boost Dorado production.

This means that nearby resources, like the recently discovered Pavo field, can potentially be tied back and produced using the Dorado floating, production, storage, and offloading vessel, Carnarvon explained.