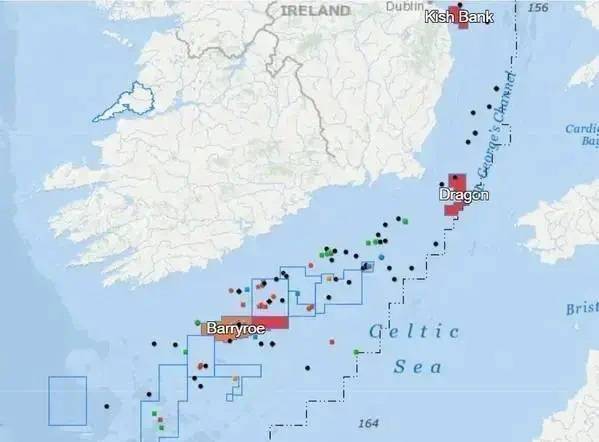

Barryroe Offshore Energy, an oil and gas company focused on developing the Barryroe offshore oil and gas field in Ireland, dubbed one of Europe's largest undeveloped offshore oil fields, might not be there to see the field brought online.

The company, previously known as Providence Resources, in May suffered a setback when Ireland's Department of the Environment, Climate and Communications ("DECC") refused to grant it and its partner a permit to proceed with Barryroe works, citing the issues with financial capability of the partners involved.

In a statement on Thursday, Barryroe Offshore Energy said that "in direct consequence of the surprising and extremely disappointing decision by the Minister for the Environment, Climate and Communications, Eamon Ryan TD, to refuse to grant the Lease Undertaking over SEL 1/11," the company has decided that it can no longer proceed with the proposed Placing and Open Offer to raise corporate working capital, as previously announced on April 6, 2023.

"The company has very limited working capital and is engaging in discussions with its substantial shareholders in relation to potentially funding the company going forward. There can be no guarantee that these discussions will be successful such that additional funding will be secured in the near future," Barryroe Offshore Energy said.

The refusal by the Minister to grant the Lease Undertaking and the consequential delay to the proposed working capital raise has created going concern issues for the company that will delay the publication of its annual accounts, Barryroe Offshore Energy said.

Barryroe Offshore Energy also said that it had enough working capital for approximately three weeks, or around €176,000 (£152,000), and that it might need to wind down the company.

"If funding is not secured in the short term one of the options being considered by the Board is an orderly wind down of the company in a process of Creditor Voluntary Liquidation ("CVL")," Barryroe Offshore Energy said.

"The company is considering all options in relation to the decision by the Minister to refuse to grant the Lease Undertaking over SEL 1/11. It will update the market on this and its financing situation as soon as practicable," Barryroe Offshore Energy said.

Lansdowne, Barryroe Offshore Energy's partner in the Barryroe license in the Celtic Sea offshore Ireland, last month said it was considering legal action after the ministry's refusal to grant the license to proceed with the Barryroe field works, to protect its investment. The company claims it has so far invested around $20 million in Barryroe.

Lansdowne last month cited the Competent Person Report carried out by RPS ("RPS CPR"), announced in February 2022, addressing simply the first phase of a Barryroe development and solely the Basal Wealden Oil reservoir, which concluded that the P50 volumes were estimated at 81.2 million barrels of oil recoverable gross (16.24 million barrels net to Lansdowne) from a Best Estimate of 278 million barrels of oil in place (STOIIP) at the Barryroe site.

Lansdowne also said it believed the field held significant gas resources which "could make a vitally important contribution to Ireland's energy mix as it transitions to a zero net carbon economy, and it is anticipated that any future phased development program will include consideration of this important gas resource."