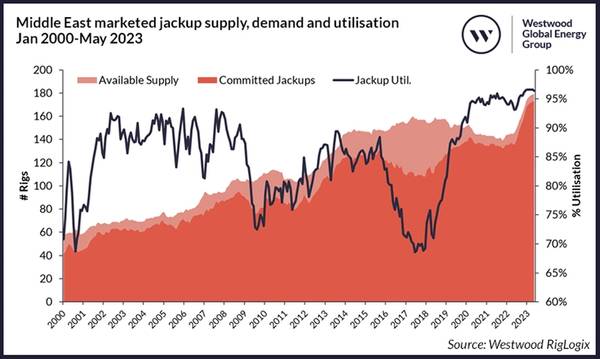

It’s hard to believe that once upon a time the Middle Eastern jackup segment comprised of less than 60 units when today marketed supply sits just shy of three times that amount (180 units

It’s hard to believe that once upon a time the Middle Eastern jackup segment comprised of less than 60 units when today marketed supply sits just shy of three times that amount (180 units). Over the past two decades, this region has suffered similar blows as the rest of world off the back of oil price crashes and global pandemics, but overall, supply and demand growth has been monumental, and it doesn’t appear to be showing signs of slowing.

The area is driven majorly by national oil companies (NOCs), such as Saudi Aramco, ADNOC and Qatar Gas’, operations in shallow waters. Between 2000 and 2010 supply of jackups in the area increased 87%, from 60 to 112 rigs, off the back of 96% demand growth in the same period. Utilisation during this 10-year cycle averaged out at a strong 85%.

Although it slowed in comparison to the previous period, the next decade of 2011-2020 brought further growth of 31% in supply and 57% in jackup demand, despite lower oil prices and a market downturn, which was in turn followed by the further blow of the Coronavirus pandemic in 2020. During this era, committed utilisation averaged just three percentage points behind the 2000-2010 period at 82%.

The last two-and-a-half years have been even more interesting for this distinct. Averaging out at a whopping 95% committed utilization between January 2021 and May 2023, and reaching the current high of 97% (as of late May 2023), demand has been steered by NOCs’ renewed focus on increasing domestic oil and gas reserves and production through additional exploration and development drilling campaigns. During this period, jackup demand increased by 27% (37 rigs) and supply reacted as needed in line with this growth at 26%. Figure 2: Middle East awarded jackup contract days by country Jan 2001-May 2023.

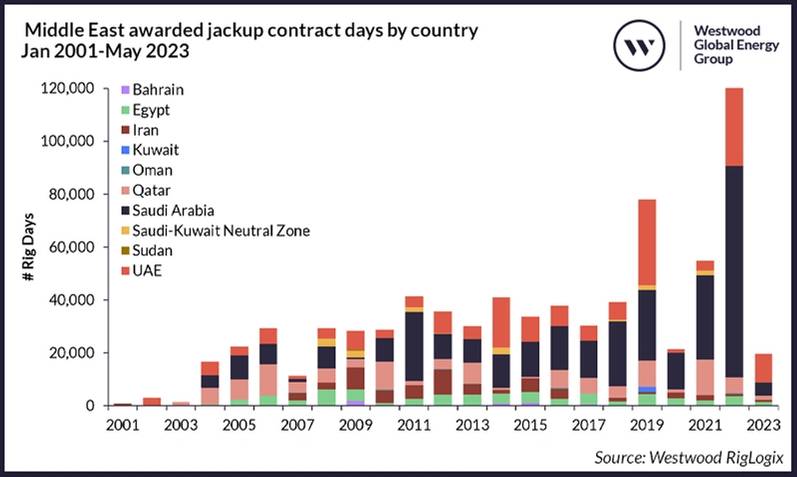

Figure 2: Middle East awarded jackup contract days by country Jan 2001-May 2023.

Source: Westwood RigLogix.

Contracting activity off the scale

Highlighting just how serious these operators are to ramp up activities is the enormous number of awards that have been made during the most recent period. For instance, from 2010 to 2020 awarded contract days for jackups in the Middle East totalled 38,829 days or 106.3 years of new contract backlog but during the much shorter January 2021-May 2023 period, operators secured 64,913 days of jackup contract days (177.8 years), which is 67% more backlog added than the previous decade combined.

Further multi-year, multi-rig tenders are also out in the market from Middle Eastern players. Of the almost 29 years of demand already out at a tender or pre-tender stage, 52% is for operations off Saudi Arabia, 39% for Qatar, with the remaining demand either from Emirati or Omani waters.

Of course, to fulfil this ever-increasing demand, rig managers have been, and still are, looking outside of the domicile to find enough capacity and have been buying up newbuilds and older tonnage from shipyards or other companies, not to mention heavy reactivation programmes, several of which are still ongoing.

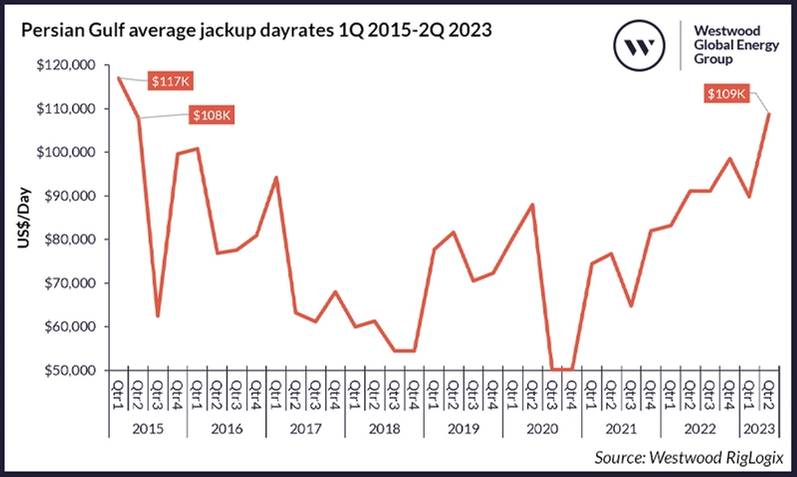

With global marketed jackup utilisation now sitting at 92%, however, finding extra rigs will not be an easy job. Worldwide, there are still 27 warm or hot-stacked units with no future work yet in place, though four are in the Caspian Sea and unlikely to be moved, most remaining active supply availability is in Europe or the Far East. Of the 57 cold-stacked jackups, which could in theory be considered for reactivation, over 60% have been idle for five years or more. While in terms of stranded or newbuild capacity, there is a choice of 17 jackups in Chinese and Singaporean shipyards. Figure 3: Persian Gulf average jackup dayrates 1Q 2015-2Q 2023.

Figure 3: Persian Gulf average jackup dayrates 1Q 2015-2Q 2023.

Source: Westwood RigLogix.Dayrates heading northward

With the combination of tightening jackup supply and growing demand, both regionally and globally, this has brought about a spike in dayrates, especially in the Persian Gulf area. Between early 2015 and late 2018, dayrates in this area were almost halved from a high of $117,000 per day to just above $50,000 per day. Some recovery in pricing was witnessed in 2019, but then quickly slashed again during the pandemic.

Between late 2020 and the present day, however, average leading edge dayrates for jackups in the Persian Gulf have increased 118% to an average of $109,000 per day in late May 2023. Over the past year, fixtures have been awarded at a low of $70,000 to a high of $155,000 per day. Recent market sentiment suggests that as the supply/demand gap continues to restrict, combined with reactivation and newbuild delivery cost economics plus inflationary pressures, dayrates in the region are set to continue their northward trajectory.