“By agreeing to an additional voluntary production cut within OPEC (Organization of the Petroleum Exporting Countries) of 500,000 barrels per day in May and announcing a further independent production cut of 1,000,000 barrels per day in July, Saudi Arabia is aiming to reduce excess supply and support prices,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.

According to the EIA (U.S. Energy Information Administration), Saudi Arabian oil production fell to 9.9 mbpd (million barrels per day) in May, a reduction of 0.7 mbpd and 7% compared to April.

“The production cuts have not yet had the desired effect on prices as average Brent oil prices still fell $9/barrel from April to May. Increased production in Nigeria, Angola, and Iran meant that total OPEC production only fell 2% m/m in May while global production was down less than 1% m/m,” says Rasmussen.

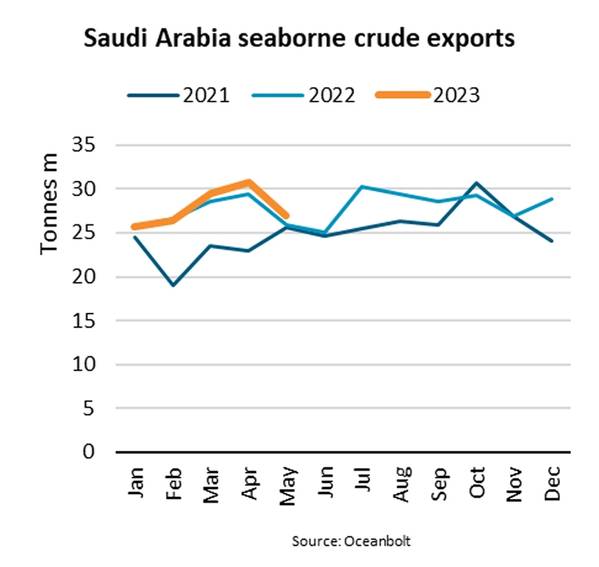

However, the production cuts in Saudi Arabia have been felt in the crude tanker market, particularly in the market for VLCCs (Very Large Crude Carriers). VLCCs export nearly 90% of Saudi Arabia’s seaborne crude oil exports, and the Saudi Arabian exports provide nearly one third of all volumes carried by VLCCs.

At the beginning of the year, China was expected to contribute more than half of the estimated increase in crude oil demand in 2023 as COVID-19 restrictions were lifted. Recently, worries that China’s recovery is proceeding slower than hoped have impacted the crude oil markets negatively.

“Year-to-date, crude oil exports to China have increased 18% y/y. May volumes, however, fell 21% m/m and ended only 6% higher than in May 2022. Saudi Arabia volumes to China fell 18% m/m in May but remained a solid 29% ahead of May last year,” says Rasmussen.

Despite the concerns, the EIA has increased their estimate for global oil consumption. Compared to their Short-Term Energy Outlook from January 2023, their latest forecast from June indicates that consumption will end at an average of 101.0 mbpd in 2023 instead of 100.5 mbpd. The estimate for Chinese consumption has equally increased and is still estimated to contribute 50% of global consumption growth.

“So far, June crude oil export volumes appear to be recovering. However, if the market follows normal seasonality, full recovery may only kick in during July and the second half of the year,” says Rasmussen.