Oil and gas company Barryroe Offshore Energy said Friday it had started the process of an orderly wind-down of the business through a Creditors Voluntary Liquidation.

As part of this process, Barryroe Offshore Energy (ex-Providence Resources), which had for years been working to develop the Barryroe offshore oil and gas field offshore Ireland, also intends to seek shareholder consent to cancel the admission of the company's ordinary shares to trading on AIM and Euronext Growth.

The move follows the recent decision by the Irish Department of the Environment, Climate and Communications (DECC), which rejected Barryroe's application for a Lease Undertaking (LU) crucial for the completion of appraisal drilling at the Barryroe oil and gas field.

The setback came at a time when the company was preparing to raise additional equity capital of up to €20 million, and according to the company, the Minister's decision effectively rendered the planned capital raising impossible, leaving Barryroe with limited working capital.

On June 8, Barryroe said it had enough working capital for approximately three weeks, or around €176,000 (£152,000).

“The very limited working capital remaining has obliged the Board to call an EGM to seek approval for the appointment of the Liquidator, to minimize the extent to which liabilities exceed remaining assets. Given the Board's decision to propose a resolution to appoint a Liquidator to the Company and considering the Company's financial position, the Board also believes it sensible to propose a resolution to cancel the Company's admission to trading on AIM and Euronext Growth,” Barryroe Offshore Energy said Friday.

If the CVL resolution is passed, Barryroe Offshore Energy will be voluntarily wound up following the appointment of the Liquidator.

Cancellation of shares

Under the AIM Rules and Euronext Growth Rules, the cancellation of shares can only take place after the expiry of a period of twenty business days from the date on which notice of the cancellation is given. In addition, a period of at least five business days following the shareholder approval of the cancellation is required before the cancellation may be put into effect. Accordingly, if the resolution to cancel the admission is approved, the cancellation will become effective at 7.00 a.m. on 1 August 2023.

Barryroe Offshore Energy's primary focus was to progress the phased commercial development of the Barryroe oil and gas field in which it held 80% stake, with partner Lansdowne owning the remaining 20%.

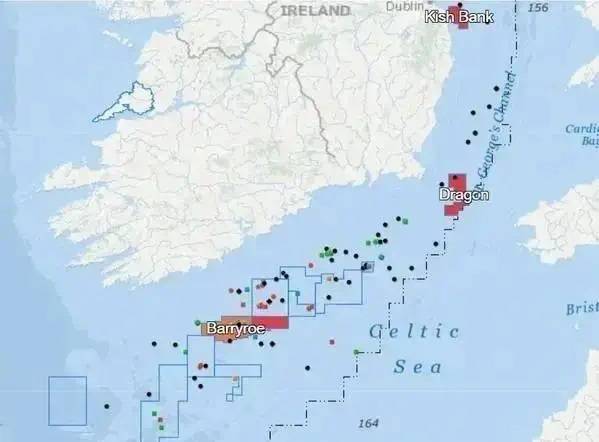

The Barryroe Field is located in 100 meters of water, approximately 50km offshore Cork, close to the Kinsale gas fields. Barryroe has been described as one of the largest undeveloped oil and gas fields offshore Europe and, per Barryroe Offshore Energy, has been independently assessed to potentially contain approximately 350 million barrels of recoverable oil/gas.

The field may now remain undeveloped, as on June 19, Barryroe announced its intention to initiate an orderly wind-down of the business through a Creditors Voluntary Liquidation ("CVL"), a move further affirmed on Friday.

Barryroe Chairman said on June 19: "It has been a disappointing and deeply frustrating time for shareholders, management, and the Board. In that context, the Board particularly recognizes and appreciates shareholder patience and support.

“The funding solution put in place in November 2022 secured €40 million held on deposit in escrow, ready to drawdown as needed, sufficient to fully cover the costs of the proposed appraisal program. Notwithstanding that secured funding, in assessing the Company's financial capability to deliver this commitment, the Minister has seen fit to apply his discretion, relying on reference to one, non-mandatory, 'financial capability guideline', arguably inconsistent with the limited scope of the work, thereby denying all efforts to progress appraisal of the Barryroe oil and gas field. In consequence, the country has lost an opportunity to improve Ireland's energy security, to reduce the emissions associated with importing oil and gas, to provide employment and future tax revenues and to diversify the country's sources of primary energy supply. All at no cost to the public purse.”

It is worth noting that following the Irish DECC decision in May not to grant its permission for further work on the offshore block containing the Barryroe field, citing issues with the financial capability of the partners involved, Lansdowne Oil & Gas said it was considering taking legal action against the Irish government.

„[Lansdowne Oil & Gas ] can advise shareholders that in recent weeks, given the considerable investment made to date by Lansdowne in the Barryroe project, the substantial potential value that the project could realize for Ireland and all stakeholders involved and the apparent lack of any progress nor any engagement by the regulatory authority, Lansdowne has been engaging with external legal counsel to assess its legal rights and the potential options available, including pursuing legal proceedings, for the purposes of protecting its investment in the Barryroe project,“ the company said in May, adding that it had no choice but to formalize the engagement with external legal counsel and pursue legal proceedings to protect its investment in the Barryroe Project.

Earlier this week, Lansdowne said that its legal advisors, Ashurst LLP, had submitted a letter to Ireland giving notice pursuant to Article 26(2)(c) of the Energy Charter Treaty, requiring Ireland to participate in discussions with a view to settling the dispute within three months of the date of such notice.

“Receipt of this letter has been acknowledged. Further updates will be made as appropriate, along with more information on the claims sought by Lansdowne in this matter,” Lansdowne said.

Lansdowne said in May it had invested c. $20 million in the Barryroe project ”to date.”

"It is with great reluctance that we must now resort to legal proceedings in relation to our investment as we would much rather have moved forward with a Lease Undertaking and appraisal drilling, for which funds had been sourced, to advance Barryroe toward development for the benefit of all stakeholders. We believe we have a very strong claim against the Irish government and the company will be resolute in defending and protecting the rights and investment of our shareholders,” Steve Boldy, CEO of Lansdowne Oil & Gas, said in May.