Offshore wind developments play a vital role in Europe's energy transition plans, but the industry may face a significant supply challenge in the coming years, with a forecasted wind tower supply crunch.

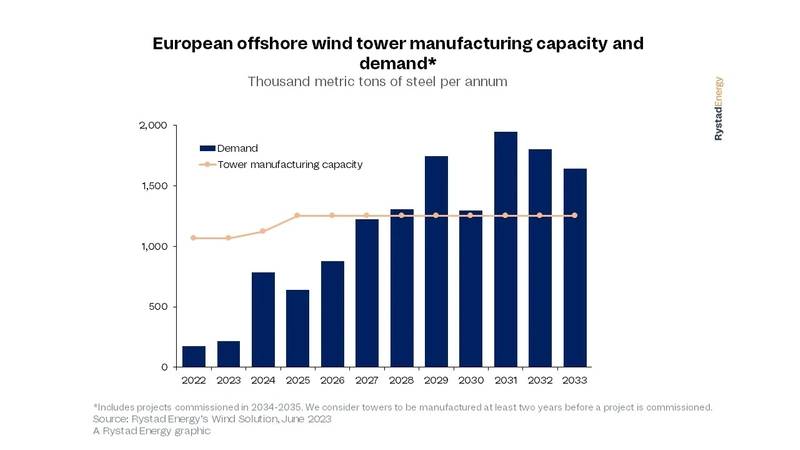

According to Rystad Energy, in 2028, the demand for offshore turbine towers will surpass the manufacturing capacity, indicating an urgent need for Europe to tackle this issue and boost manufacturing capabilities.

Rystad Energy’s offshore wind capacity outlook shows that wind tower manufacturing capacity will keep pace and exceed demand before 2028.

However, Rystad said, that year is the turning point, and in 2029, demand will surpass manufacturing capacity by a significant margin.

Steel demand for offshore wind towers will total more than 1.7 million tonnes in 2029, but manufacturing capacity will be a maximum of around 1.3 million tonnes, meaning supply can only meet about 70% of demand, Rystad said.

Great Opportunity, but new Capacity Needs to be Added Now

If Europe is to reverse this trend, manufacturers need to start boosting capacity in the next two years, as it takes between two and three years to build new facilities. These forecasts assume no major steel shortage, so manufacturers can work at full capacity. If a shortage materializes, Europe could face a supply issue even earlier than expected.

Alexander Flotre, vice president, Rystad Energy said:"Turbine sizes keep growing as the importance of offshore wind to the global power grid accelerates, and tower demand is projected to surge accordingly. This is a golden opportunity for manufacturers to capitalize on increased demand, but new capacity needs to be added imminently if Europe is going to avoid a supply headache."

Since constructing a tower manufacturing facility can take three years, European producers must initiate more expansions within the next two years, at the latest. They should not find this problematic as wind towers are made of steel, with no particularly complex or specialized machinery required, Rystad said.

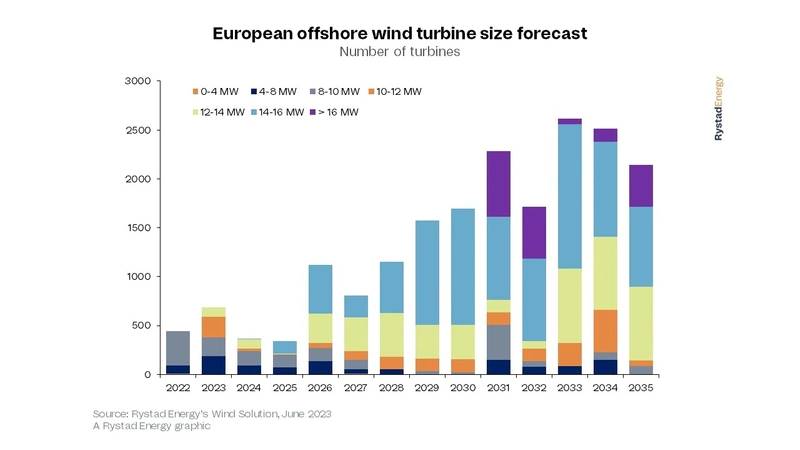

While the average turbine capacity fixed in Europe in 2023 is expected to reach almost 10 megawatts (MW), Rystad Energy estimates that 50% of the total turbines installed between 2029 and 2035 will be bigger than 14 MW, with some projects forecasting to build 20-MW at the beginning of 2030.

"It is instructive to note that a tower’s weight varies with the hub height, which is required to be more than half of the rotor diameter – excluding the clearance to the water surface – and which fluctuates from country to country," Rystad explained.

"In addition, as rotor dimensions grow, turbine sizes increase and larger towers are required. This growth is more prominent in Europe, where offshore wind developers have requested turbines of 12 MW or larger for their projects," Rystad said.

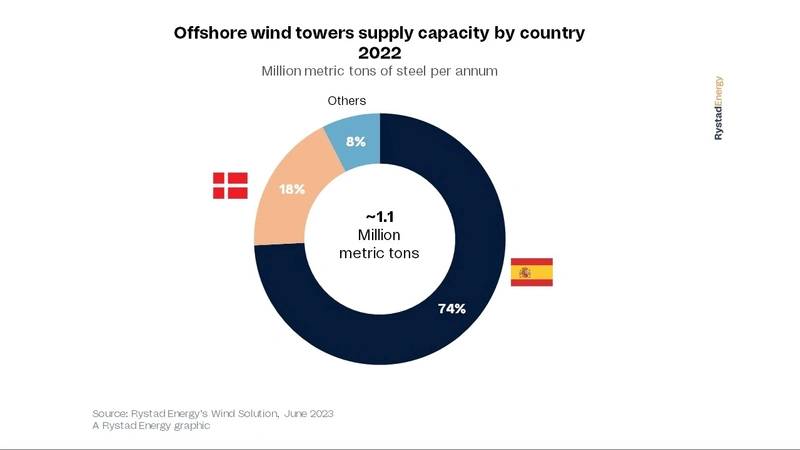

Spain and Denmark lead the European offshore wind tower supply, accounting for about 90% of the estimated 1.1 million tonnes of the continent’s supply.