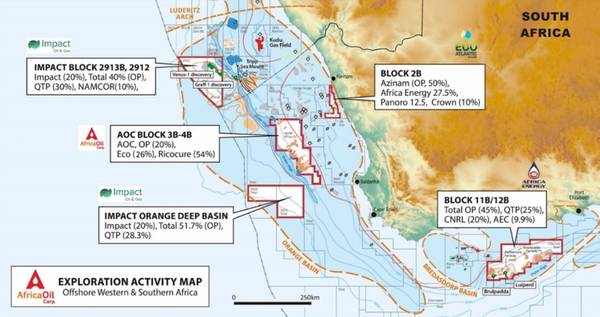

Africa Oil Corp. has entered an agreement to increase its operated working interest (“WI”) in Block 3B/4B, located in the Orange Basin offshore South Africa and, the company says, on trend with the Venus, Graff, La Rona and Jonker oil discoveries in the nearby Namibia, for an additional 6.25% interest.

An independent review of the prospective resources and probability of geological success of an inventory of exploration prospects within Block 3B/4B, has reported total unrisked gross P50 prospective resources of approximately 4 billion barrels of oil equivalent.

Probability of success ranges from 11% to 39% over the 24 prospects identified Africa Oil Corp. said.

Africa Oil Corp. has signed a legally binding Letter of Intent (“LOI”) with Azinam Limited (“Azinam”), a wholly owned subsidiary of Eco (Atlantic) Oil & Gas Ltd. (“Eco”), to acquire the 6.25% interest for a total cash consideration of USD 10.5 million, to be paid in tranches after certain milestones, including government approval, third party farm-out completion, and spudding of the first exploration well.

Africa Oil Corp. is a major shareholder in Eco with a 15.02% shareholding. The Company’s Directors, other than Mr. Keith Hill, who is also a Director of Eco, have reviewed and approved the terms of the LOI.

The company will hold an operated WI of 26.25% subject to and, on the receipt of the government’s approval for the transfer, with Azinam holding a 20.00% WI and Ricocure (Proprietary) Limited holding the remaining 53.75% interest.

Africa Oil Corp. and its Block 3B/4B partners are progressing plans to conduct a two-well campaign on the block and are in discussions with various potential partners to farm out up to a 55% gross working interest in the Block.

Block 3B/4B covers an area of 17,581 km2 within the Orange Basin offshore of the Republic of South Africa. This block lies to the southeast and on-trend with a number of oil discoveries, including TotalEnergies' Venus and Shell's Graff, both made last year in Namibia.

According to Africa Oil Corp., an independent review of the block’s prospective resources has been completed by RISC Advisory (UK) Limited (“RISC”), in accordance with RISC has reviewed the prospective resources and probability of geological success of 24 exploration

prospects within Block 3B/4B in accordance with the PRMS.

The report provides an evaluation of prospective resources from a prospect inventory identified using 3D seismic data and follows

completion of the reprocessing of 2,200 km2 of 3D seismic data and play-opening discoveries in Namibia including TotalEnergies’ Venus discovery and Shell’s Graff, La Rona, and Jonker light oil discoveries.

These discoveries prove the existence of a working petroleum system for light oil, gas condensate and gas in the geological play fairway. The proven reservoirs in Graff and Venus discoveries are similar to Cretaceous reservoirs and geological plays that would be targeted in Block

3B/4B. Prospects in Block 3B/4B are identified using 3D seismic data to assess the presence of seismic attributes including amplitude-variation-with-offset (“AVO”) or direct hydrocarbon indicators (“DHI’s”).

According to Eco Atlantic, the application process for a permit to drill one well and one contingent well (and potentially up to five wells) within an area of interest in the north of Block 3B/4B remains underway.

Gil Holzman, Co-Founder and Chief Executive Officer of Eco Atlantic, commented:""We are very pleased to agree this transfer of a portion of our WI on the Block to our strategic alliance partner Africa Oil.

The restructure of the WI will result in Africa Oil holding 26.25% and Eco 20% and will strengthen the JV position amid ongoing negotiations with third parties to farm into the Block and execute a drilling campaign. Since Africa Oil is already established as JV partner and Operator on the Block, receipt of the requisite regulatory approval for the transfer is expected to be straight forward.

"We look forward to continuing our work with the South African government and regulatory bodies in terms of our Environmental Authorisation process and in the active exploration of Block 3B/4B. The initial cash to be received from Africa Oil will enable Eco Atlantic to fund its growth opportunities elsewhere and with no shareholders dilution, while maintaining a strategic and considerable 20% working interest in this highly prospective Block (pre-farm out to a third party)."