Oil and gas company Kistos said Friday that its appeal against the Netherlands Ministry of Economic Affairs' decision not to extend the term of the M10/M11 offshore license had been successful.

"This ruling is effective immediately and the licence is extended by five years. Kistos NL1 B.V. holds a 60% operated working interest in the licence and is partnered with EBN (40% working interest)," Kistos said.

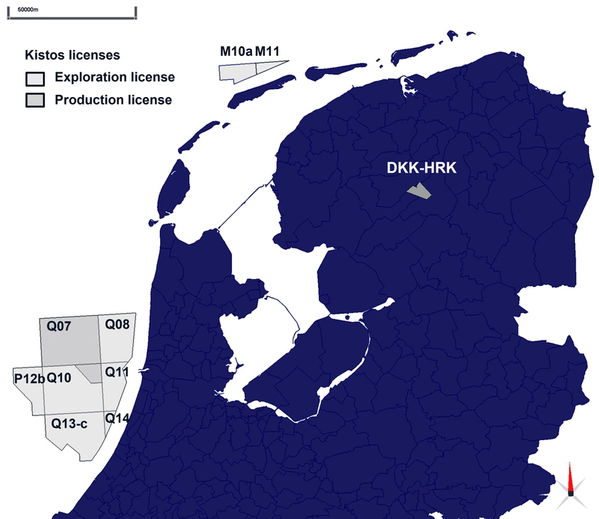

The M10/M11 license is located in the northern section of the North Sea Shelf offshore the Netherlands, and, Kistos says, is estimated to contain technically recoverable 2C resources net to Kistos of 174 Bcf or 31.7MMboe.

"These resource estimates have been independently compiled in a technical report undertaken by a third party in accordance with the Petroleum Resources Management System (PRMS) standards for classification and reporting. Kistos has completed stakeholder mapping in preparation for further drilling of the field," Kistos said.

Kistos will now apply for a permit for an appraisal well, engaging closely with the local municipalities and stakeholders prior to commencing any assessment phase planning work.

"As a result of this positive news, Kistos estimates Group 2P reserves of 36.2MMboe and 2C resources of 72.2MMboe, making the overall Group 2P reserves plus 2C resources, 108.4MMboe," Kistos said.

Andrew Austin, Executive Chairman of Kistos, said: "This is very good news both for Kistos and for the Netherlands. It increases the potential for domestic gas demand to be met with domestic supplies, which has positive implications for CO2 emissions. Whilst the delay to the M10/M11 project has been frustrating, we are pleased that the right outcome has been achieved and look forward to working with the local municipalities to obtain the relevant permits to appraise the field. We continue to work with our partners in all three jurisdictions to mature further resources to reserves prior to year-end."

Kistos acquired its Dutch North Sea assets in 2021 after by buying Tulip Oil's Dutch subsidiary Tulip Oil Netherlands for 220 million euros, plus 163 million euros of contingent payments, and 5 million euros of warrants.

The company at the time got hold of an operating interest in the Q-10A offshore gas field, the Q-10B, Q-11B, and M10/M11 discoveries, and other exploration and appraisal projects in the Dutch North Sea.