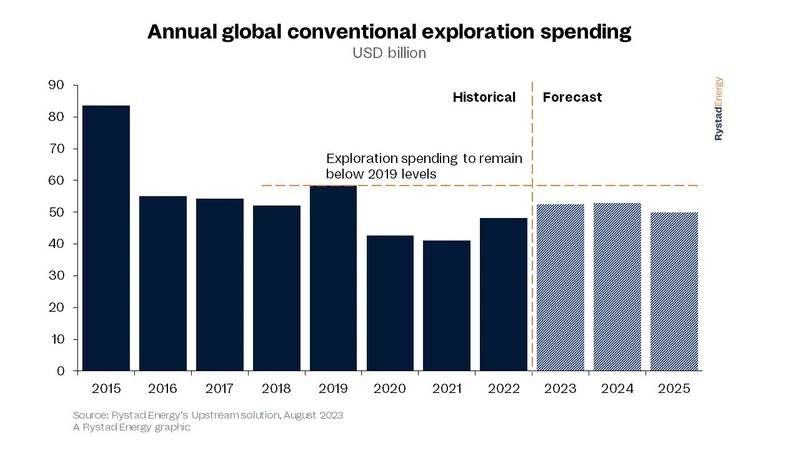

Spending on conventional oil and gas exploration is on the rise and is set to top $50 billion this year, led by offshore investments, however, discovery volumes are falling to new lows, despite the rising investments. This is according to Rystad Energy, a Norway-based energy industry intelligence group.

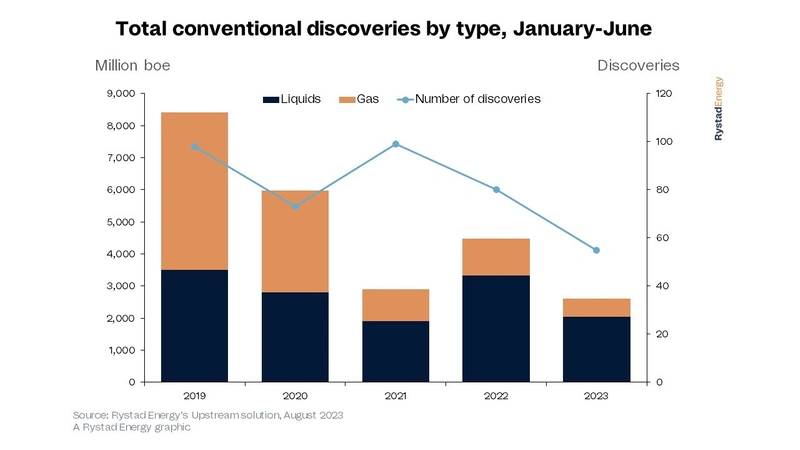

Rystad's estimates show that in the first half of 2023, explorers found 2.6 billion barrels of oil equivalent (boe), 42% lower than the first half of 2022 total of 4.5 billion boe.

Fifty-five discoveries have been made, compared to 80 in the first six months of last year. This means discoveries in 2023 have averaged 47 million boe, lower than the 56 million boe per discovery for the same period in 2022.

"The exploration and production (E&P) industry is in a transitionary period, with many companies exercising increased caution and shifting their strategies to target more profitable and geologically better-understood regions. This strategic shift and the failure of several critical high-potential wells are contributing to the precipitous drop," Rystad said.

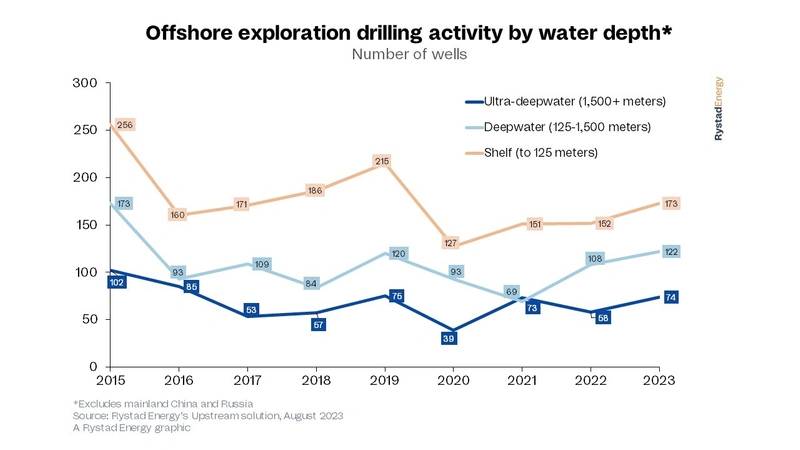

According to Rystad Energy, in the hunt for new resources, exploration companies are prioritizing the offshore sector, trying to capitalize on underexplored or frontier areas to unlock new volumes through high-risk, higher-cost offshore developments.

The offshore industry accounted for about 95% of exploration spending this year to date but only about two-thirds of discovered volumes, Rystad said.

“Upstream companies are facing a period of uncertainty. They are eager to capitalize on the increased demand for fossil fuels and find additional resources, but recent results have been lackluster. If exploration efforts continue to yield unimpressive results for the remainder of the year, 2023 could be a record-breaker for the wrong reasons,” says Aatisha Mahajan, vice president of upstream research at Rystad Energy.

Where are the resources?

The continued growth of Guyana’s Stabroek offshore block means the Caribbean country leads the way in discovered volumes, with 603 million boe in 2023. Turkey sits second with 380 million boe, Nigeria with 296 million boe and Namibia with 287 million boe, with the potential for these estimates to grow as we better understand the reserves.

Offshore discoveries are spread relatively evenly between ultra-deepwater, deepwater and shelf finds. However, we expect increased activity in the remainder of 2023, especially in the ultra-deepwater market, with projected growth of 27% versus 2022 in terms of spud wells.

Failed high-impact wells

Rystad Energy's research shows that 31 high-impact wells – designated using its tiering system based on the project’s significance and production potential – are expected to be drilled this year.

So far, 13 have been completed, six are ongoing and 12 remain in the pipeline.

Only four of the 13 completed wells encountered hydrocarbons, a measly 31% success rate, Rystad says.

The results of three wells are not yet disclosed, while the remaining six failed to find any reserves. These failures significantly impact the total discovered resources and greatly contribute to the falling discoveries, the company said.

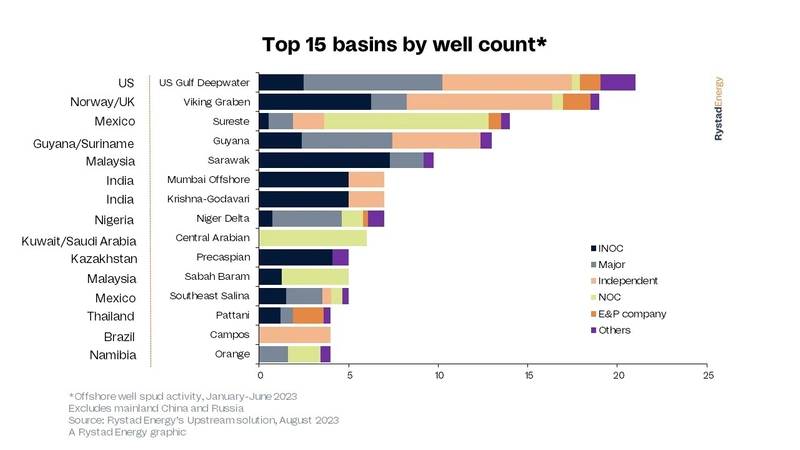

The six majors – ExxonMobil, BP, Shell, TotalEnergies, Eni and Chevron – continue to play a critical role in global exploration, with a prominent share of exploration spending and global conventional discovered volumes. The six companies are expected to spend about $7 billion this year on exploration, about 10% higher than in 2022.

Exploration activity will likely gain momentum in the second half of 2023, with crucial exploration wells planned to be drilled, Rystad says.

"Our forecasts show that the majors will contribute about 14% of total global exploration spending in the coming months, highlighting their relative significance in an environment where exploration has pivoted to the offshore sector, with an increased focus on frontier regions. These underexplored or virgin regions hold some of the most technically prospective yet-to-be-drilled prospects, with majors playing a vital role in recent years in exploring these areas," Rystad says.

According to Rystad, the spending and activity profiles of the majors position them firmly in the market, but national oil companies (NOC) have the most extensive subsurface resource base at their collective disposal. More than half of the projected exploration spending in 2023 will come from NOCs and NOCs with international portfolios (INOC).

However, Rystad says, there may yet be some success to come this year, as only 30% of anticipated wells have been completed, highlighting the magnitude of the remaining activity.

"Only 23 of the remaining 56 exploration wells are either drilled or are expected to be drilled this year, meaning about 60% are likely to be drilled or postponed until 2024. So, even if 2023 proves unsuccessful, a rebound could be on the cards next year," Rystad says.