Taiwan's state-owned energy company CPC said Wednesday it had received Australian government approval to acquire four subbasin permits in oilfields off Western Australia from Carnarvon Energy.

CPC's subsidiary OPIC Australia Pty Ltd reached the deal with Carnarvon in February, in which Carnarvon agreed to divest a 10% interest in the Dorado oilfield.

Carnarvon said in a February release that it expected to receive $146 million in cash from the investment. This comprises an upfront payment of $56 million on completion of the transaction and another $90 million once a final investment decision is taken on the Dorado development.

(Reporting by Ben Blanchard; Editing by Jacqueline Wong)

From Offshore Engineer:

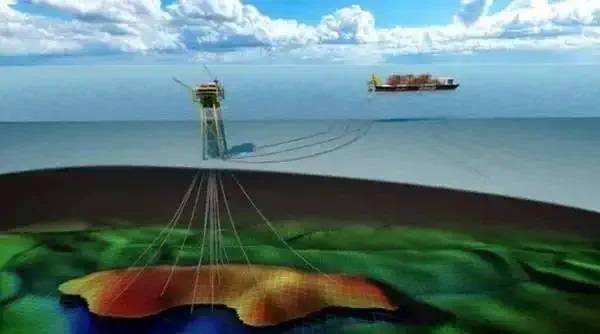

The Dorado field is operated by Santos, which is working to develop the Dorado using an FPSO and a wellhead platform.

Back in February, the Australian offshore oil and gas safety regulator NOPSEMA accepted Santos' Offshore Project Proposal (OPP) relating to the Dorado project.

The accepted OPP covers approval to undertake the Dorado Phase 1 liquids development, including the reinjection of gas to enhance resource recovery, as well as tie back future resources within the ‘project area’ covered by the OPP to boost Dorado production.

This means that nearby resources, like the recently discovered Pavo field, can potentially be tied back and produced using the Dorado floating, production, storage, and offloading vessel, Carnarvon, Santos' partner in the project, has explained.