While trouble areas continue to emerge in the young U.S. offshore wind industry, analysts at Intelatus Global Partners maintain an optimistic outlook for the industry in the long term.

The business intelligence and consulting firm said in its latest U.S. Offshore Wind Report that it sees long-term foundations for the U.S. offshore wind sector solidifying, referencing several positive advancements such as the recently announced auction of three shallow water lease areas with at least 3.6 gigawatts (GW) of capacity in the Gulf of Mexico at the end of the month, with 16 operators prequalified to participate. On top of the Louisiana and Texas auction activity, federal agencies are moving forward to prepare the groundwork for the auction of three shallow water Central Atlantic sites able to support 4.3-8.2 GW of capacity early in 2024.

Up north, Maine has formalized a 3 GW offshore wind installed capacity target by 2024, which is expected to require floating wind technology. As a result of Maine's new offshore wind goal, states have committed and have announced procurement targets amounting to over 105 GW. Delaware is also investigating establishing an offshore wind procurement target.

However, in the short-term, cost inflation and interest concerns continue to create challenges for operators who have secured both leases and state offtake award, Intelatus said.

Avangrid will pay penalties to three Massachusetts utilities to cancel its Commonwealth Wind power purchase agreement (PPA), while SouthCoast Wind is also negotiating with the Massachusetts utilities to cancel its PPA.

BP has confirmed that it and Equinor are seeking to renegotiate PPA terms with New York agencies for its northeast portfolio, which includes Empire Wind 1 & 2 and Beacon Wind.

In New Jersey, Orsted is facing legal challenges over the state bill that was passed to support its Ocean Wind 1 development. Another project in New Jersey, Atlantic Shores, is seeking the same treatment to make its project financially viable.

Rhode Island chose not to select the sole bid in its recent solicitation, Orsted's Revolution Wind 2, as the project was seen as too expensive in the current market conditions.

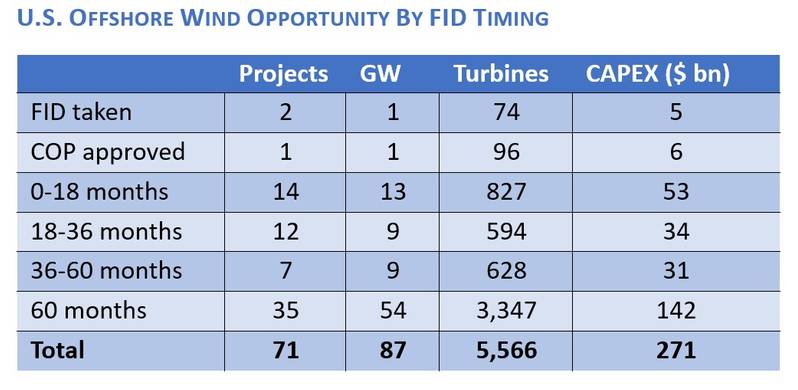

Despite the challenges, Intelatus siad it maintains its forecast for more than 70 projects that will install close to 87 GW of capacity in this and the next decade and a total 110 GW by 2050.

“Forecasts for storm clouds in the short term have done little to dampen the positive long-term outlook for U.S. offshore wind,” said Philip Lewis, director of research at Intelatus Global Partners. “The industry remains on track to meet its long-term targets despite recent negative trends.”

(Source: Intelatus Global Partners)

(Source: Intelatus Global Partners)

According to Intelatus, the 87 GW forecast capacity will require capital expenditure amounting to around $271 billion to bring onstream, a recurring annual operations and maintenance spend of $8.6 billion once delivered, and close to $38 billion of decommissioning expenditure at the end of commercial operations.