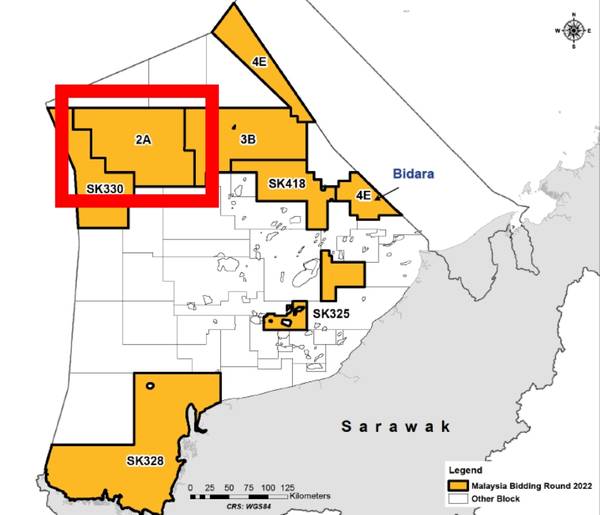

Longboat Energy, an E&P company active in Norway and Malaysia, has agreed to acquire privately held Topaz Number One Limited ("Topaz"), increasing its working interest in the Production Sharing Contract over Block 2A offshore Sarawak, Malaysia ("Block 2A") to 52.5%.

Topaz's sole asset is a 15.75% working interest in Block 2A, which Longboat entered in February 2023 through the award of a Production Sharing Contract, alongside partners Petronas Carigali Sdn. Bhd (40%), Petroleum Sarawak Exploration & Production Sdn. Bhd. (7.5%) and Topaz.

The block contains what has been described as a giant 'Kertang' prospect. It covers approx. 12,000 km2 and is located in water depths of between 100-1,400 meters. According to Longboat Energy, the block contains a "number of large prospects across multiple plays have been identified, with significant volume potential representing multiple trillions of cubic feet of gas."

"Following completion of [the Topaz] transaction, Longboat will hold an operated 52.5% interest in Block 2A, simplifying the process towards a positive well decision and the potential introduction of an additional funding partner prior to drilling," Longboat said.

The Topaz team, comprised of James Menzies (former CEO of Coro Energy) and Pierre Eliet (former Lundin Energy and Roc Oil director), will join Longboat Energy, bringing extensive regional expertise and an established network, accelerating Longboat's ambitions to build a full cycle E&P business in SE Asia.

Helge Hammer, Chief Executive of Longboat Energy, commented: "We are pleased to have increased our interest in the extensive and prospective Block 2A in deep water Sarawak, which contains the giant Kertang prospect. Sarawak has seen significant exploration success in recent years, and we are excited to play a role in the quest for additional gas resources in the area.

"We welcome James and Pierre to Longboat. Their extensive experience and network from SE Asia combined with our in-house technical expertise, puts us in a strong position to deliver accelerated growth in the region. In parallel with maturing Block 2A towards the drilling decision, we focus on adding production and development assets to our portfolio in SE Asia."

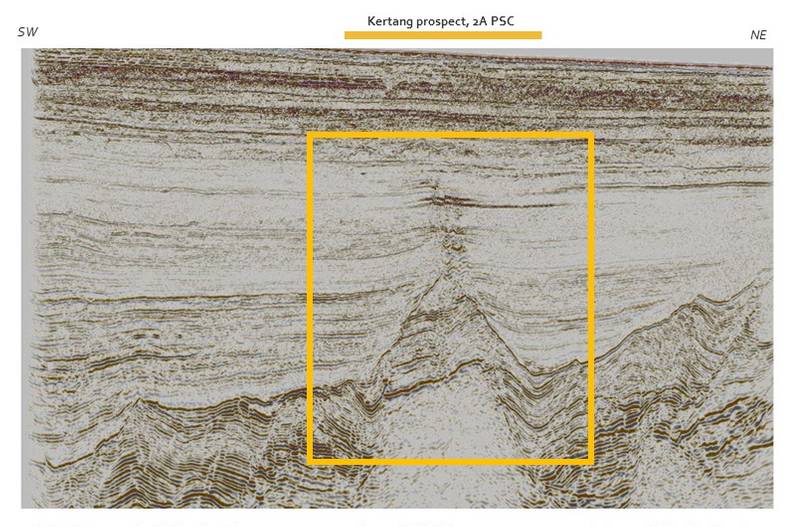

According to Longboat Energy, the Kertang prospect is a large anticlinal structure with a closure of over 100km2 at multiple levels and significant volume potential representing multiple trillions of cubic feet (TCF) of gas in stacked reservoirs. Seismic indicators for the presence of gas can be observed in the area and over the crest of the prospect. Credit: Topaz Number One Limited

Credit: Topaz Number One Limited

The consideration for the acquisition will be satisfied in three tranches: an initial issue of new ordinary shares of 10 pence each in the company equivalent to US$100,000; upon completion of the acquisition; a contingent amount of US$125,000 payable in cash or through a further issue of Ordinary Shares of an equivalent value, upon an exploration well being committed on Block 2A or a farm-out; and a contingent amount of up to US$3,000,000 payable in cash or through a further issue of Ordinary Shares of an equivalent value, upon a discovery being made on Block 2A, depending on the resource size and the growth in the price of the Ordinary Shares measured over a two year period.

Longboat Energy said it believed that an equity position of this size [52.5%] would accelerate the drilling of the Kertang prospect by simplifying the process towards a positive well decision and the potential introduction of an additional funding partner prior to drilling.