The North Sea jack-up rig market has been out of the limelight lately, overshadowed by increased contracting activity in the semi-submersible rig market, resulting in the departure of some of these units from the region. As the North Sea outlook remains soft, what’s on the cards for those remaining jack-ups without future commitments?

New jack-up fixtures for work in the North Sea have been few and far between up until August this year, indicating the continuation of soft demand in the region, which is expected to continue for the rest of this and early next year.

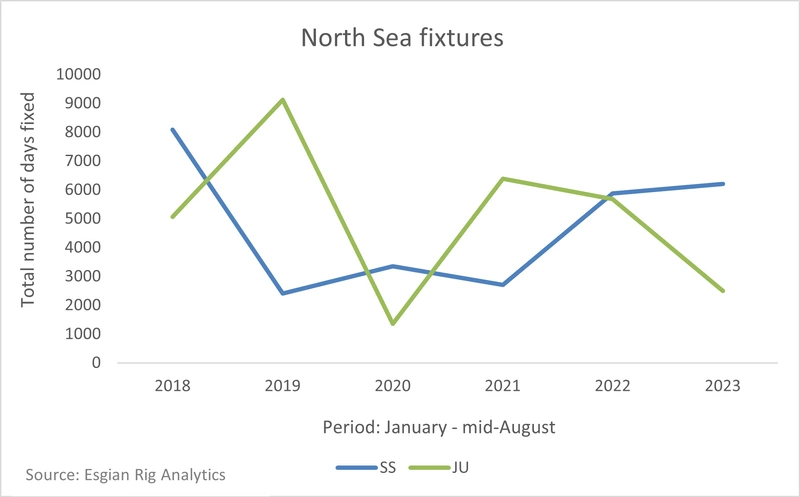

The total number of jack-up fixtures until mid-August 2023, including exercised options, was below levels achieved in the same periods over the last couple of years.

As a result, the total number of jack-up days fixed in this period is significantly lower when compared to the same periods of 2022 and 2021 but somewhat higher than the 2020 lows. However, before 2020 and the COVID-19 pandemic happened, the number of days fixed in 2019 was significantly higher compared to all the following years. Looking at the difference between the same periods in 2018 and 2023, we see that the number of days halved this year.

On the other hand, Esgian sees a different trend when it comes to semi-sub fixtures in the North Sea. The total number of semi-sub days fixed in 2019 decreased significantly from 2018 levels only to increase a bit in 2020. After that, the numbers go down again in 2021 and increase over the next two years.

Recent noteworthy jack-up fixtures in the North Sea include Noble Lloyd Noble’s contract with Equinor in Norway for a term of 270 days. The contract for the 500-ft CJ70 unit is scheduled to begin between May and July 2024 with a dayrate of about $225,000. Options for two additional wells with a total duration of 230 days could keep the rig occupied until Q4 2025.

In the UK sector, CNOOC booked Shelf Drilling Fortress for a firm duration of four to five months and options for additional wells with a total duration of about 13 months, which could keep this rig busy into early 2025. The contract started less than three weeks from the announcement date as the rig was in a yard and readily available for new work from early 2023.

Meanwhile, Harbour Energy has been on a hiring spree this year. The UK operator contracted two Valaris and one Noble unit in the UK, thereby securing rig capacity into early 2026, and one Noble CJ70 unit for an exploration well in Norwegian waters at a dayrate of $205,000.

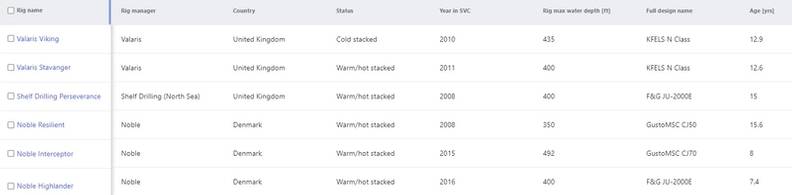

When all is said and done, there are currently seven jack-ups in the North Sea region, excluding Russia (North), without future commitments. Three of these are in the UK and three are in Denmark, and their average age is 11.9 years, which means they're relatively young. Most of them have been idle for less than a year, and only one, the Noble Highlander, has been warm-stacked for over a year and a half. North Sea - available JU rigs; Source: Esgian Rig Analytics

North Sea - available JU rigs; Source: Esgian Rig Analytics

See the full image here: https://bit.ly/3Pk7r3D

Noble currently has a total of five idle units in the North Sea. Excluding the Noble Intrepid, which has an upcoming contract with Harbour in late 2023, and Noble Regina Allen, which is undergoing repairs in the Netherlands but is not part of the North Sea fleet anyway, three ex-Maersk units remain, all of which are warm stacked in Denmark. However, Noble doesn’t have a lot of optimism for adding new work to their backlogs for the rest of this and early next year.

Following recent mobilizations of Valaris Norway and Valaris 72 to the North Sea, Valaris now has two available jack-ups in the region, the warm-stacked Valaris Stavanger and the cold-stacked Valaris Viking. The two N Class rigs had previously worked in Norway for years but moved to the UK in late 2022 and early 2023, respectively, due to a lack of opportunities. As Norway’s jack-up market struggles to recover, Valaris still doesn’t expect any of these to be working in the country during 2024.

Finally, Shelf Drilling North Sea has one available unit in the region, the Shelf Drilling Perseverance, ex-Noble Hans Deul, which has been warm-stacked since July 2023.

So, what are the likely scenarios for these remaining, unemployed units should efforts to secure work in the North Sea fail to bear fruit in the coming months?

As contractors get under pressure to reduce costs on unemployed units, there’s the obvious solution of putting them in cold stack mode but this type of action is not without faults as bringing such a unit back when demand recovers is costly and takes time. In addition, reactivating such a unit would require a longer-term commitment, the likes of which haven’t been seen in the North Sea lately.

Also, with the tightening of the semisub supply in the region, there’s a possibility for jack-up units to take up some of the work that was previously done by 3rd and 4th Gen moored semisubs. This is where Valaris and Noble units would be capable of stepping in, specifically, Noble’s one available CJ70 unit, the Noble Interceptor, and Valaris N class unit, Valaris Stavanger.

Another viable option is to seek work outside of the region, which is what many contractors have been doing lately. Much like we’ve seen in the semi-sub sector over the last couple of years, certain jack-up units have also left the North Sea region for opportunities elsewhere.

In addition to Borr Drilling’s Ran leaving the UK for Mexico, Shelf Drilling Odyssey (ex-Noble Houston Colbert) moving to Qatar, and Borr’s Prospector 5 to Congo, the 400-ft Valaris 247 will be leaving the region in early 2024 for a CCS contract in Australia with potential for follow-on work.

However, should the North Sea demand recover, the rig’s return to the region would be subject to an operator paying for its mobilization. Moreover, the North Sea’s highly regulated environment means that additional costs would have to be factored in for the rig’s return.

As challenges within the harsh environment jack-up market in the North Sea persist, rig owners continue to seek new opportunities elsewhere. Namely, Borr Drilling has recently secured a short-term extension for the Prospector 1 with Neptune in the North Sea. However, this extension is meant to bridge the gap towards favorable long-term commitments elsewhere as the contractor is actively marketing the unit for opportunities around the globe.

Meanwhile, Shelf Drilling Perseverance, which completed its contract in the UK earlier than expected because of lack of funding, is also being actively marketed for multiple opportunities worldwide.

Being the only cold-stacked jack-up in the region, Valaris Viking may be another candidate for leaving due to a lack of longer-term opportunities in the North Sea, which would be necessary to bring it back to work.

As the situation in the North Sea market continues to be out of balance with other regions where demand is strong - including the Middle East, India, and lately Southeast Asia – operators may show more willingness to pay for mobilization costs to be able to secure suitable rigs for their campaigns.

Should these units come from the North Sea, this would inevitably result in further tightening of the supply in the region and more uncertainty in the longer term where we’ll be seeing potential new demand coming from new exploration and production licenses in the UK and Norway, carbon capture and storage (CCS) projects, as well as increasing P&A backlogs.

About the author:

Nermina Kulović is an offshore rig market analyst within Esgian.

The article above was originally published on Esgian's website and republished on OEDigital.com with the author's permission.