Karoon Energy announced deals worth $720 million on Thursday to buy stakes in certain offshore oil and gas fields in the Gulf of Mexico from U.S.-based LLOG Exploration, in a move to diversify operations beyond Brazil and Australia.

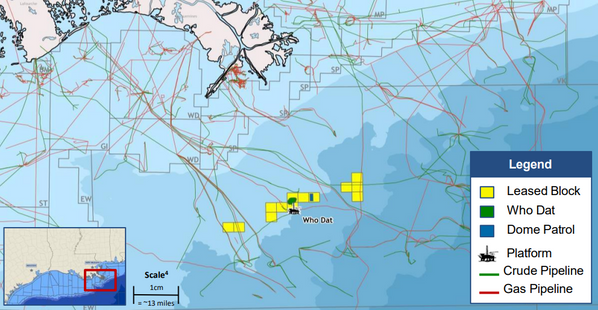

The oil and gas explorer said it would raise around A$480 million ($312.43 million) to fund a 30% stake purchase in the Who Dat and Dome Patrol fields in offshore Louisiana and a near 16% stake buy in the Abilene field.

Karoon Energy will issue shares under the equity-raising at A$2.05 apiece, a 14.6% discount to the stock's Tuesday close. Shares of the company were on a trading halt on Wednesday.

Macquarie Capital is acting as sole lead manager and underwriting the capital raise.

Deepwater oil and gas operation field Who Dat is expected to add around 4.0 million-4.5 million barrels of oil equivalent to Karoon Energy's 2024 total output on a net revenue interest.

LLOG, whose operations are backed by buyout giant Blackstone and which is one of the largest privately owned oil and gas companies in the United States, has been for long looking to sell its Gulf of Mexico oil exploration joint venture.

Karoon Energy said the Who Dat field addition would help offset a natural production decline from its Bauna offshore operations, which it had acquired from Brazil's state-controlled Petrobras in 2020.

Its oil sales jumped 66% in the September quarter to $203.9 million, while production stood around 2.85 million barrels.

The company will drawdown $274 million from a new $340 million debt facility that it has signed with a syndicate of banks including Macquarie and Deutsche Bank to partially fund the stake buys.

($1 = 1.5363 Australian dollars)

(Reuters - Reporting by Rishav Chatterjee in Bengaluru; Editing by Shilpi Majumdar and Subhranshu Sahu)