As the world looks to renewable energy sources to combat climate change and reduce reliance on fossil fuels, offshore wind has emerged as a promising frontier in the United States. A report by the University of California Berkeley released in August concluded that due to the nation’s long coastlines with sustained winds in many areas and falling turbine costs, offshore wind could feasibly supply between 10% and 25% of the country’s energy demand by 2050.

While that may paint a rosy picture of a cleaner, greener future, achieving that level of energy production hinges on overcoming a series of logistical and operational challenges, one of which is the efficient and sustainable transfer of personnel and equipment to and from offshore wind installations.

Crew transfer vessels (CTV) are considered a workhorse in the offshore wind industry, and one of the few ship types used throughout every phase of an offshore wind project. To support the expansion of U.S. offshore wind and to sustain it for the decades to come, a more robust U.S.-flagged fleet of CTVs is needed. Against the backdrop of the maritime industry on a mission to decarbonize, hybrid solutions can play a significant role in developing a U.S.-flagged CTV fleet that is fit for the future.

A fitting solution

Increasing commercial and regulatory pressures on shipping have shown a spotlight on the efficiency, flexibility, and reliability of hybrid and fully electric vessel designs. There is increased interest in electric solutions across the industry, including for CTVs, whose operating profile is well suited for the technology.

“Vessels operating on predictable routes are a good fit for electrification,” said Ed Schwarz, vice president of sales marine systems at ABB Marine & Ports, noting that the exact operating profile of CTVs for U.S. offshore wind remains to be ironed out, but that CTVs will generally operate in near-coastal lease areas and on routine schedules. The uniqueness of these vessel’s charter adds to the appeal for electrification. “The investment cost is still somewhat higher for electric propulsion versus diesel-mechanical, however, considering the daily operations of these vessels and the length of their charter, for CTVs the rate of return on that capital investment is much shorter.”

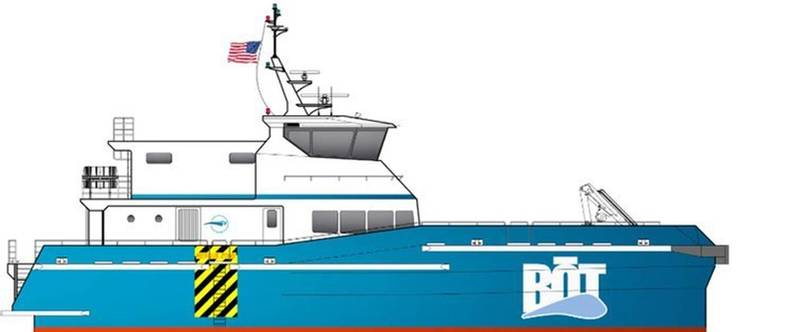

The fuel cost generally falls on the energy company chartering the vessel, giving CTV owners vying for contracts a competitive advantage when implementing hybrid solutions that optimize fuel efficiency and reduce emissions. “That’s how we look at it,” said Jack Cammarota, director of marine operations at Blue Ocean Transfers. Blue Ocean Transfers (BOT) is a U.S. flag shipping company delivering Jones Act-compliant crew transport and transfer services to the U.S. offshore wind market and keeping a close eye on hybrid solutions for its fleet.

“There is currently a flurry of new construction happening along with existing vessels being retrofitted to enter the space and fill gaps in coverage,” Cammarota said. He acknowledges that the limited availability of CTVs today leaves a runway open for modified assets, but that there will come a time when they won’t pass muster anymore for a multitude of reasons. “We intend to bring a premier level of robust support and service to offshore wind, which leads us to take a longer view. It’s not just about satisfying market demand between now and in 2030, but what technologies will make the most sense for a CTV in the market in 2030 and beyond.”

“The investment cost is still somewhat higher for electric propulsion versus diesel-mechanical, however, considering the daily operations of these vessels and the length of their charter, for CTVs the rate of return on that capital investment is much shorter.” – Ed Schwarz, VP of Sales Marine Systems, ABB Marine & Ports (Photo: ABB)

“The investment cost is still somewhat higher for electric propulsion versus diesel-mechanical, however, considering the daily operations of these vessels and the length of their charter, for CTVs the rate of return on that capital investment is much shorter.” – Ed Schwarz, VP of Sales Marine Systems, ABB Marine & Ports (Photo: ABB)

The technology benefits

“There are several ways fuel efficiency improves with diesel-electric propulsion,” Schwarz explained. “The ability of electrical motors to generate full torque at zero speed makes power available immediately for increased operational safety, and without the requirement to over-torque. Additionally, greater responsiveness due to variable frequency operations enhances maneuverability, and it offers greater overall fuel efficiency.”

From an operational standpoint, at reduced propeller speeds, the number of supplying generators can be matched according to power demand, thereby reducing engine wear and tear, and lowering the maintenance cost for a diesel-electric system. If the vessel has only one engine type on board, there are additional operational savings to be had with the reduction in spare parts required.

“It isn’t just lowering lifecycle cost or minimizing the standstill time required for maintenance and service,” Schwarz noted. Configuration of a diesel-electric propulsion system offers better redundancy for more reliable operations. “Power can be distributed to either propulsion motor, minimizing the risk of single-point failure resulting in a total loss of propulsion. Undoubtedly, this enhances safety for the ship’s crew and the personnel being transported. Meanwhile, it’s also a more comfortable experience for those onboard due to lower noise levels and vibration.”

Diesel-electric systems also provide greater flexibility in vessel design, as heavy equipment can be more evenly distributed throughout the vessel when configuring the propulsion system. The design of a hybrid CTV can be developed to allow for better utilization of the onboard space, enabling the vessel to better serve its operating duties. “This is key because weight is always an issue in the CTV world,” Cammarota said. “To put more in you must take something away, reduce the carriage size, etc. That’s the last thing you want when your goal is to create a workboat solution that’s ready for any challenge it faces.”

Hybrid propulsion provides a host of opportunities and benefits for new construction when looking into the future as well, Schwarz explained: “The increased connectivity of diesel-electric systems allows for new and future sources of energy to be introduced to optimize efficiency.” This connectivity also improves efficiency by providing access to critical equipment and operational information, which enables ABB to support operators with guidance on predictive engine maintenance, insight into vessel performance, and even the ability to perform remote diagnostics.

Blue Ocean Transfers is keeping a close eye on hybrid solutions for its fleet. (Image: Blue Ocean Transfers)

Blue Ocean Transfers is keeping a close eye on hybrid solutions for its fleet. (Image: Blue Ocean Transfers)

Growth in shore power

Of course, shore charging infrastructure is essential to the viability of hybrid propulsion for CTVs, but according to Schwarz, there is a promising outlook there. “Worldwide there is a growing imperative to reduce emissions,” he explained. “Across the United States, we see more attention, action and investment to develop shore-based power installations as part of the overall effort of port decarbonization, which involves transitioning to cleaner energy sources and improving operational practices to reduce emissions.”

Shore connection for vessels is a key innovation that will improve port operational practices. While in port, a vessel traditionally would draw from its diesel auxiliary engine power to generate electric power to maintain onboard essential functions, including lights, air-conditioning, etc. Shore power charging allows a vessel to instead, plug in and access electrical power from shore while docked, thereby enabling for the ship’s auxiliary engines to be shut down. With access to connect to shore power in port, vessel emissions can be reduced significantly.

Notably, a significant percentage of U.S. offshore wind lease areas are near major population centers, which are also home to port communities that have been plagued by air and noise pollution that is largely attributed to vessels using heavy fuel oil in ports. The connection of offshore wind energy to the grid can have a major and positive impact on the ports’ energy system. “Having a sustainable energy model behind electrification enables true decarbonization,” Schwarz said.

Going the distance

What’s been said about collaboration being key to achieving maritime decarbonization can be applied similarly to achieving the growth targets for U.S. offshore wind. While it may be a long shot, reaching the goal of 30 gigawatts (GW) of U.S. offshore wind by 2030 is only attainable through increased stakeholder engagement and the strengthening of cross-sector collaboration.

“A lot of things are siloed in the space right now, and I think that’s hindering market development and, ultimately, industry growth,” Cammarota noted. “More cooperation and engagement from stakeholders—both public and private—and more transparency across the board would help to mitigate delays and get things off the ground a little bit better. This industry is full of amazingly talented individuals, it’s only a matter of bringing folks to the table to flush out the solutions we need to reach our goals.”