German utility RWE on Thursday said it would acquire three offshore wind projects off the English coast from Sweden's Vattenfall in a deal that values the assets at 963 million pounds ($1.2 billion).

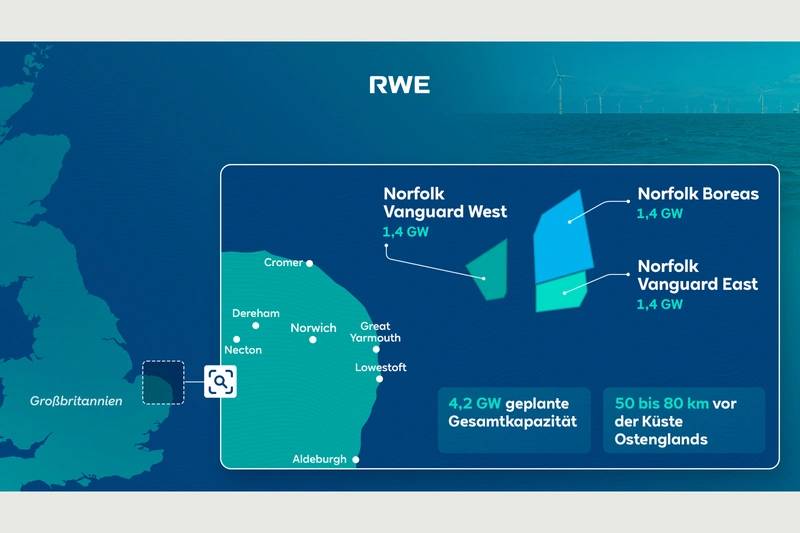

The UK Norfolk Offshore Wind Zone portfolio consists of three 1.4 gigawatt projects, RWE said. The transaction was expected to close during the first quarter of 2024, it said.

"Vattenfall believes the agreement with RWE is the best way forward both for the company and for the Norfolk projects," the Swedish company said in a separate statement.

Vattenfall earlier this year paused the development of Norfolk Boreas, one of the wind farms included in the Norfolk cluster, citing a mismatch between rising costs and the electricity sales prices it agreed to.

"This divestment means the impairment and provisions Vattenfall reported earlier this year will be reversed," it said.

Vattenfall said at the time that the decision to halt Norfolk Boreas would hit earnings by 5.5 billion Swedish crowns ($543.95 million).

RWE said it will resume the development of the Norfolk Boreas project.

The other two projects, Norfolk Vanguard West and Norfolk Vanguard East, would seek a contract for difference in one of the upcoming UK auction rounds, it added.

"All three Norfolk projects are expected to be commissioned in this decade," RWE said.

(Image: RWE)

(Image: RWE)

($1 = 0.7894 pounds)

($1 = 10.1112 Swedish crowns)

(Reuters - Reporting by Christoph Steitz and Nora Buli; Editing by Leslie Adler)