Industry continues chasing big oil, key gas targets also on the radar

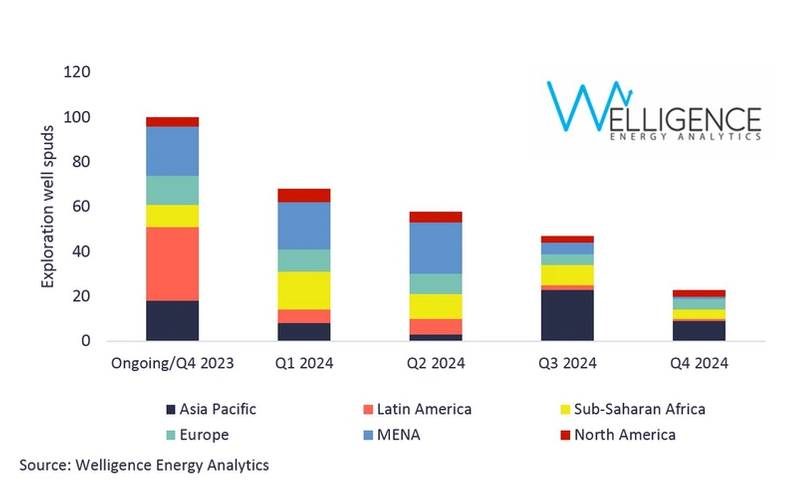

Global exploration drilling is set for a boost in 2024 – we have line of sight on over 200 wells targeting over 30 bnboe of resource (unrisked). Several gas hotspots are on the industry agenda, whilst the strong appetite for oil exploration in new and proven plays will continue on both sides of the Atlantic. Much of the activity is underpinned by increased drilling in MENA, Sub-Saharan Africa and Asia Pacific. Drilling in North America, South America and Europe looks set to remain stable.

The well count through 2024 will grow as companies finalise budgets and solidify exploration plans.

The well count through 2024 will grow as companies finalise budgets and solidify exploration plans.

The well count through 2024 will grow as companies finalise budgets and solidify exploration plans

Despite some cost pressures, and a growing energy transition agenda which is seeing some companies shift focus away from hydrocarbons, the appetite for both oil and gas exploration persists.

In Brazil, we’re closely watching Petrobras’ Morpho-1 (Foz de Amazonas), a potential play opener in the country’s Equatorial Margin. And it’s not all about the Brazilian NOC, other operators are preparing to drill – PETRONAS and bp will be drilling the Mola-1 and Pau Brasil-1X wells respectively, both located in the pre-salt. While the days of multi-billion finds in the pre-salt are almost certainly over, the play still has material running room.

On the other side of the Atlantic, the world-class status of the Orange Basin in Namibia will be better defined in 2024 as other companies get involved following the success achieved by TotalEnergies and Shell – wells are planned by Galp (PEL 83-2X), Chevron (PEL 90-1X) and Woodside (PEL 87-1X). The recent hiatus in ultra deep-water exploration in Congo-Brazzaville and Senegal/Guinea Bissau is set to be broken, with wells planned by TotalEnergies (Niamou) and CNOOC (Pangolin).

Near field, infrastructure-led exploration (ILX) drilling is the focus in Europe and the US Gulf of Mexico. However, some wells such as Equinor’s Rondeslottet and Aker BP’s Arkenstone in Norway show there remains material potential outside mature plays, with combined pre-drill volumes in these prospects totalling >1 bnboe. It’s a similar story in the US Gulf of Mexico, where planned wells such as Hess’ Corvus-1 and Chevron’s Vancouver-1 are both targeting >100 MMboe.

The world wants gas, and the deep waters of the Eastern Mediterranean will see continued exploration. One well to watch is Eni’s 7 Tcf Orion well in Egypt currently drilling ahead with results expected in Q1. The demand for gas that can be delivered into domestic and regional markets (in this case Europe) is a big driver of activity. Similarly, growing gas demand in Indonesia, both locally and to meet export needs, combined with material undeveloped reserves, means this is a key exploration focus, particularly offshore in the North Sumatra Basin. Harbour Energy’s Halwa and Gayo wells are two such examples. And over in South America, Ecopetrol is also seeking to satisfy Colombia’s hungry domestic market with its deepwater Orca Norte well in the Caribbean Sea.

Selected exploration wells to watch - 2024.

Selected exploration wells to watch - 2024.

The Majors will continue to account for a significant share of global exploration investment, operating around 30% of wells. The peer group will drill the majority of high-impact wells, but with a strong regional focus. All but one (Argentina) of Equinor’s wells are in Norway. ExxonMobil and TotalEnergies are focussed on the exploration hotspots of Guyana and Sub-Saharan Africa, respectively. Shell will be the most active in 2024, chasing targets in Malaysia and Oman. Eni and bp, the latter with minimal operated drilling planned in 2024, are largely concentrating efforts in the Eastern Mediterranean.

However, the independents are also set to drill important and potentially needle moving (in the success case) wells. Galp and Woodside (Orange Basin, Namibia), Harbour Energy (North Sumatra, Indonesia) and Aker BP (Norway) are three such examples.