While scientists hail their advances in producing green hydrogen directly from seawater, others see it as pointless.

The idea of getting rid of the pre-treatment of seawater that is required to provide pure water to electrolyzers seems to make sense – it reduces costs, footprint and energy consumption, ultimately reducing the cost of producing green hydrogen.

However, the challenges are considerable. The NaCl in seawater would lead to the production of chlorine gas. “If we were to meet the world’s hydrogen needs without solving this issue first, we’d produce 240 million tons per year of chlorine each year – which is three to four times what the world needs in chlorine,” said RMIT University’s Dr Nasir Mahmood on announcing his team’s development of new catalyst technology that could overcome the problem.

The energy savings available are a mere rounding error in terms of system efficiency, and the cost of reverse osmosis equipment is a tiny fraction of the cost of a hydrogen plant.

The energy savings available are a mere rounding error in terms of system efficiency, and the cost of reverse osmosis equipment is a tiny fraction of the cost of a hydrogen plant.

Paul Martin, Process Engineering Consultant, Spitfire Research

“Seawater electrolysis is a solution that is looking for a problem,” says Bart Kolodziejczyk Associate Director at Boston Consulting Group. In a blog explaining his stance, he says the complexity of performing electrochemistry in seawater is high due to the large number of organic and inorganic species it contains. The cost and energy benefits, meanwhile, are negligible.

This is partly because desalination technology is already efficient. Prof. Mohamed Mamlouk of Newcastle University says its cost depends on parameters such as feed water salinity, plant capacity and labor costs. Reverse osmosis has the lowest investment, total water cost and footprint and is better suited to offshore wind farms than other technologies. While fouling can occur, redundancy or a store of fresh water could account for shutdowns.

The benefits of seawater electrolysis are speculative at best, says Paul Martin, process engineering consultant at Spitfire Research. The energy benefit of eliminating reverse osmosis water purification is 0.035kWh versus 50-65kWh to make a kilogram of hydrogen from water. “The energy savings available are a mere rounding error in terms of system efficiency, and the cost of reverse osmosis equipment is a tiny fraction of the cost of a hydrogen plant.

“Yes, people in deserts worry that foolish hydrogen companies will steal what little fresh water they have available, but the best hydrogen production projects will be on the sea where hybrids of wind and sun will raise capacity factor and make the projects more economical,” says Martin.

That’s not to say that transporting hydrogen to shore to replace the coal and natural gas used by industry will be more economically viable than using locally available electricity ashore. To think otherwise is what Martin calls single fuel substitution thinking, and it could stem from the desire to have a gas that might eventually and gradually replace natural gas.

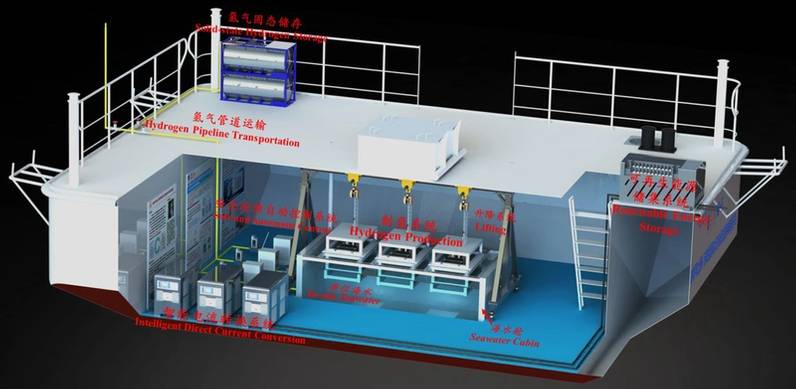

In-situ direct electrolysis of seawater without desalination for hydrogen production live test

In-situ direct electrolysis of seawater without desalination for hydrogen production live test

Source: Shenzhen University

“If you're Japan or South Korea or somewhere that doesn't have any other options, and you want to import molecules for energy, what you're admitting is that your major industries are going to be completely bankrupt. There are economic competitors in the world that will be using electricity directly and paying about a tenth as much per joule for energy as you are.”

Still, On December 16, 2022, a mere 16 days after the publication of a seawater desalination research paper by Shenzhen University researchers, Dongfang Electric Corporation made a dedicated investment of 30 million RMB ($4.2 million) to help develop the technology. This resulted in the world’s first successful test of direct seawater electrolysis for hydrogen production offshore from wind power in June 2023. The demonstration achieved stable, continuous operation for over 240 hours.

The researchers claim that the elimination of seawater transportation, desalination and the treatment of the brine produced reduces the costs of hydrogen production to slightly higher than the cost of grey hydrogen from coal and significantly lower than the cost of blue hydrogen derived from natural gas.

The plan now is to make the technology more efficient, more stable, more scalable and more intelligent. This, they say, will lead to a comprehensive zero-carbon hydrogen energy development pathway in China and distinctive electrolysis hydrogen production industrial models.

Economic folly?

Time will tell. Floating platform for renewable energy utilization and seawater hydrogen production.

Floating platform for renewable energy utilization and seawater hydrogen production.

Source: Shenzhen University