The safe, timely and cost-efficient decommissioning of offshore infrastructure is one of the big challenges faced by the oil & gas sector.

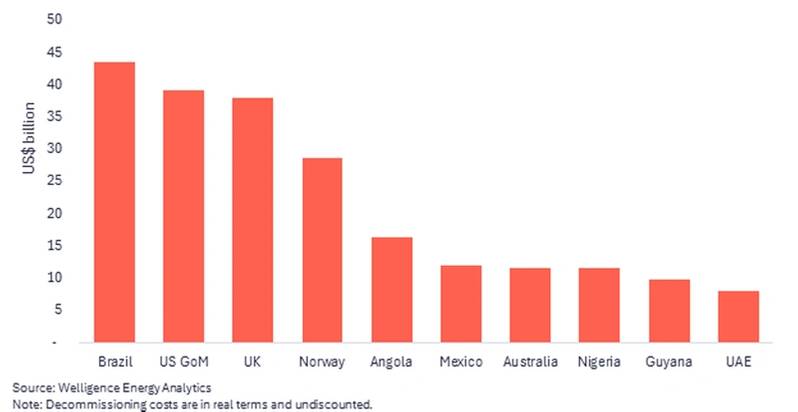

We estimate that the liability currently stands at over $300 billion (real terms), and this will only increase as companies continue to make and develop new discoveries. Key offshore producers Brazil, the US Gulf of Mexico (US GoM), the UK, and Norway face the largest bill at almost $150 billion combined.

Global Offshore Decommissioning – Estimated Cost by Country

A key concern for governments is ensuring the sector is able to cover these abandonment obligations, and the costs don’t end up with the taxpayer. Several high-profile offshore bankruptcies in recent years have revealed regulatory weakness that left the taxpayer on the hook. Countries have been working to tighten their rules, most recently in the US where the regulator (BOEM) introduced new rules for the US Outer Continental Shelf (OCS) that have placed the topic front and center.

Diving into the US GoM Abandonment Landscape

The US GoM is one of the areas most impacted, accounting for almost US$40 billion of the global bill – around 80% of this is attributable to deepwater projects. The major cost item is subsea well abandonment. While most facilities can be floated off and sold for scrap, the wells must be dealt with in-situ and require the use of vessels to plug and abandon the wellbore. Per reporting to BOEM, this cost averages $28 million per well.

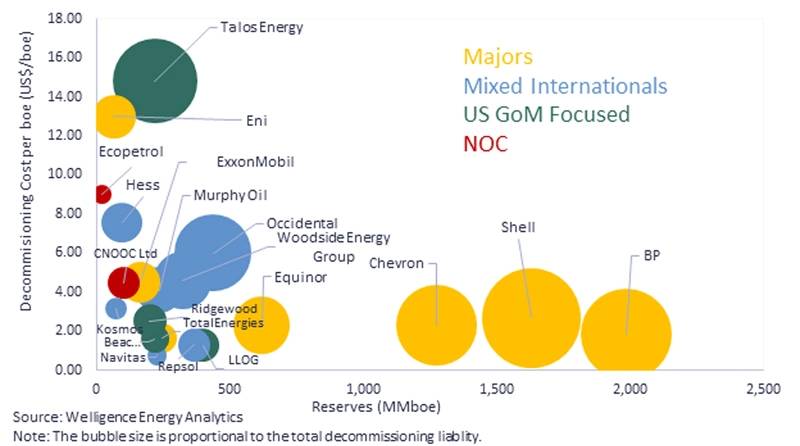

According to the regulator, there are almost 100 companies with some type of liability in the US GoM. The majority of the liability (around 70%) is associated with the top 15 E&Ps, all sizeable companies with large balance sheets and major participants in deepwater projects. The most exposed are the three big legacy producers (bp, Chevron, Shell), along with Talos Energy given the large infrastructure-based portfolio it has built through its M&A strategy over the last few years.

Deepwater Decommissioning Liability by Company – The Most Exposed

Protecting the Taxpayer – Chain of Ownership and Sureties

Governments are putting in place regulations to ensure abandonment liabilities don’t end up with the taxpayer. A couple of cases underline this concern. In Australia and New Zealand, fairly recent E&P bankruptcies resulted in $215 million and $192 million respectively in costs falling onto taxpayer shoulders. Indeed, the US Department of Interior states that the new rules covering the US OCS will “…protect taxpayers from covering costs that should be borne by the oil and gas industry when offshore platforms require decommissioning”.

The new rules have faced significant pushback from the industry, which argues it will impact investment and deal-making. But such rules should not come as a surprise– the US is now in line with Brazil, the UK, and Norway, all of whom have implemented similar regulations in recent years.