Santos has effectively stalled plans for a Western Australian oil and gas project worth over A$3 billion ($1.87 billion), sending minority partner Carnarvon Energy's, shares tumbling on Tuesday.

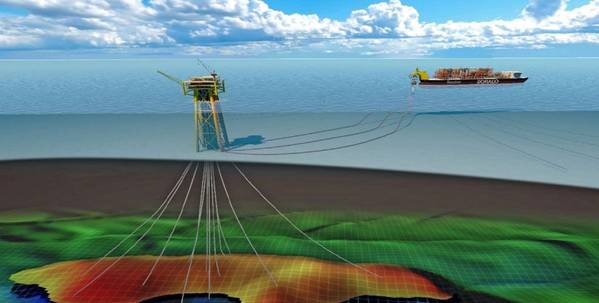

Carnarvon's shares closed about 23% lower, ending the day as the top loser on the local all ordinaries index, after the firm said Santos had dumped plans to buy an oil production and storage vessel at the Dorado project and expressed intentions against starting engineering and design work.

Shares of Santos, which owns 80% of the Dorado project, ended 2.2% lower on Tuesday. Carnarvon and Taiwan's state-owned CPC Corporation own 10% each.

"After a detailed assessment of all relevant factors, Santos recommended to the joint venture that the development concept for Dorado be revisited after further evaluation of Bedout Basin resources," a spokesperson for Santos told Reuters.

Santos' primary focus for 2025 remains delivering on its crucial Barossa and Pikka gas projects, it added. Its CEO Kevin Gallagher had warned in August and again at an investor briefing in November that the oil and gas major would put a high priority on shareholders returns.

CPC Corporation did not immediately respond to a Reuters request for a statement.

The project's slowdown poses a major risk to Carnarvon, as its primary asset is its 10% stake in the Dorado project.

The company has been, for some time, facing shareholder angst over its valuation, with the Australian Financial Review reporting last year that it had given its bankers the go-ahead to seek bids for the sale of the company or its assets.

($1 = 1.6051 Australian dollars)

(Reuters - Reporting by Rishav Chatterjee in Bengaluru; Editing by Janane Venkatraman)