As governments and investors alike push for greater and faster decarbonization, upstream operators are under increasing pressure to act. Divesting out of fossil fuels is an option, but one that runs the risk of only passing the ‘dirty’ assets to another player. An alternative is to cut operating emissions, an area where platform electrification is playing a crucial role.

Norway has been electrifying platforms for nearly 30 years, delivering significant emissions savings. While electrification in the UK has yet to take off, the North Sea Transition Deal's decarbonization targets have thrown it into the spotlight. Can the UK replicate Norway's success?

Tackling the power source for offshore installations is a vital step in the decarbonization journey. With around two-thirds of operating emissions coming from power consumption – production, processing and liquefaction – switching to low-carbon power from renewable sources can achieve significant savings.

Norway embarked on this journey decades ago, and activity continues to ramp up. Nearly US$5 billion of platform electrification spend will be sanctioned in the next two years, according to Lens Upstream. (Those sanctioned by the end of 2022 will benefit from temporary tax terms that improve the economics.)

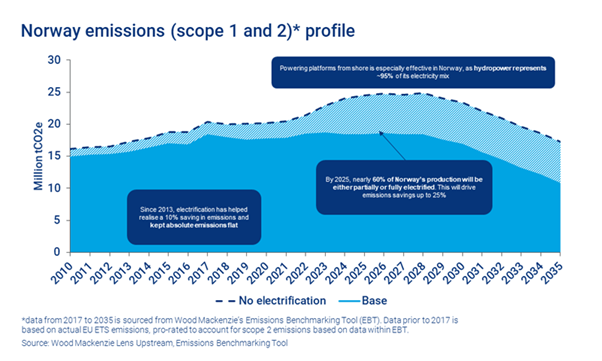

Norway’s strategy is paying off. Electrification has helped to realize emissions savings of around 25% and kept absolute emissions flat, despite an increase in activity and infrastructure. Chart shows Norway emissions (scope 1 and 2) profile

Chart shows Norway emissions (scope 1 and 2) profile

Earlier this year, the UK’s North Sea Transition Deal set a target to reduce emissions from oil and gas production by 50% by 2030. This ambitious target has focused attention on platform electrification.

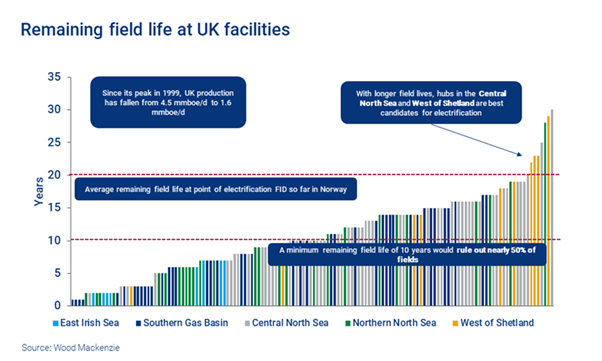

But it is not straightforward. The economics are challenging, particularly given field maturity in the UK. Norwegian fields have typically had 20 years of remaining life before being electrified. In the UK a minimum remaining field life of 10 years would rule out nearly 50% of fields; 20 years would rule out over 90%.

With longer field lives, hubs in the Central North Sea and West of Shetland are the best candidates – but significant investment and rapid action will be needed to meet North Sea Transition Deal targets.

Chart shows the remaining field life at UK facilitiesWhat will spark investment in UK platform electrification?

Chart shows the remaining field life at UK facilitiesWhat will spark investment in UK platform electrification?

Wood Mackenzie sees four key barriers to UK electrification:

1. Carbon pricing

While carbon prices have increased following the recent gas supply crunch, they are still too low to incentivize electrification. Without cost reductions or funding support, an eye-watering carbon price of US$250/tonne would be required to cover the capital cost of a typical standalone electrification project.

2. Costs

Costs need to come down. Collaboration, allowing multiple fields and partners to share infrastructure, is needed. Hub-led solutions have typically reduced costs by 50% on an emissions-saved basis and could bring the ‘carbon breakeven’ price down to US$125/tonne. State grants, similar to Norway’s NOx fund, would bring it down further.

3. Treatment of capex

There is limited tax relief in the UK compared to Norway. Uplift on capital spend associated with decarbonization (not just against supplementary charge payments) would encourage investment. Refunds on tax losses, similar to those for E&A spend in Norway, would incentivize companies not in a tax-paying position.

4. Power source

The UK currently lacks the infrastructure to power offshore electrification. Grid access and regulation around pricing needs to be prioritized. Power from the Norwegian Grid is an option, but supply and regulatory concerns could result in push-back. Offshore wind is another candidate, and with costs coming down it could be an important part of the solution.

The logistics and economics of platform electrification are undeniably complex and challenging. But a combination of more stringent carbon prices, hub-led solutions, and an increase in capital solutions could provide the vital spark.

Authors

Lucy King, Research Analyst, North Sea Upstream and Neivan Boroujerdi, Principal Analyst, North Sea Upstream, Wood Mackenzie