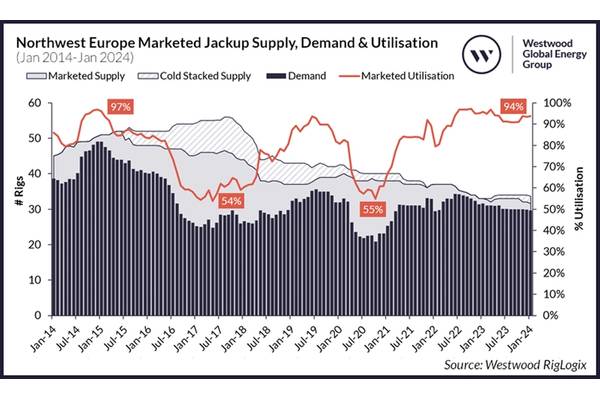

Global jack-up marketed utilization has been on an upward trajectory since 2017, reaching its peak of 94% at the end of 2023. However, the outlook for the year ahead looks somewhat flat, though there is still time for new demand.

The North Sea jack-up market has improved year-on-year since 2017, except for a blip in 2020 when the pandemic kicked in. However, booming demand isn’t the main driver behind this but instead a shrinking fleet.

According to RigLogix data, North Sea committed utilization of the marketed fleet was at a low of 54% in February 2017, which was represented by a supply of 46 units with only 25 units committed.

Committed utilization steadily increased to 89% for the full year of 2019, however plunged 23% during the pandemic, with 25 units committed of a total 40 supply units, reaching a trough of 66% on average for 2020, with the lowest point of 55% marked during October of that year.

By year-end 2023, utilization hit 93%, represented by 30 committed rigs out of a marketed supply of 32 units.

Shrinking Supply Follows Lower Demand

Between January 2018 and October 2021, a total of 18 units left the fleet and were either sold for non-drilling purposes, converted to Mobile Offshore Production Units (MOPUs) or scrapped.

Additionally, during December 2021, Noble Highlander became idle. In July 2022, Borr Drilling’s Ran relocated to Mexican waters, and in February 2023 Valaris took the decision to preservation stack Valaris Viking ‘due to ongoing weakness and uncertainty being seen in North Sea jack-up market over the next year’.

Between the last quarter of 2023 and the time of writing, five units completed offshore campaigns.

All of these units have future work in place, however, two have or will leave the region in the first quarter of 2024 – the Shelf Drilling Perseverance (Vietnam) and Valaris 247 (Australia).

During 2017, there was a total of 16,700 days of contract backlog awarded, with the lion’s share coming from Norway (10,816 days), followed by the UK (5,407 days) and only 477 days of work awarded in the Netherlands.

Contract backlog plummeted in 2020 to a mere 2,737 days awarded in total, however a strong recovery in 2021 saw awarded backlog more than triple to 9,424 days.

Fast forward to 2023 and this figure again declined to only 4,927 awarded days, with the UK sector awarding the largest proportion (3,807 days) and Norway awarding the least (303 days).

North Sea drilling activity has mimicked the peaks and troughs of the offshore industry over the past decade but has been in decline since the first quarter of 2015 by 50% to 60%.

Meanwhile, plug and abandonment work has increased, which helped to cover some of the shortfall in new drilling activity.

<subhead>

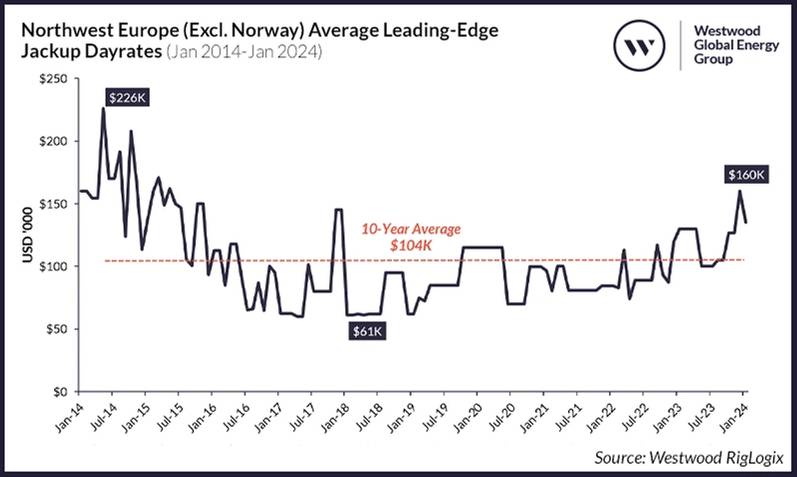

Dayrates Moving North, But More Lucrative Deals Lurk Elsewhere

Dayrates replicate where the market is in the cycle. When it comes to the North Sea, rates have been lagging behind some other regions.

Due to this and other contributing factors, including challenging tax regimes, the lack of certainty in the North Sea has driven drilling contractors to bid into regions offering longer duration programs, often with higher dayrates.

Northwest Europe (Excl. Norway) Average Leading-Edge Jack-up Dayrates (Jan 2014-Jan 2024). Source: Westwood RigLogix.

Northwest Europe (Excl. Norway) Average Leading-Edge Jack-up Dayrates (Jan 2014-Jan 2024). Source: Westwood RigLogix.

Westwood estimates that there are eight tenders yet to be awarded for work set to commence during 2024, totaling some 1,178 days.Market sources suggest that three or possibly four campaigns, such as Shell’s UK Southern North Sea two-well program for exploration and appraisal drilling (targeting the Selene and Pensacola prospects), along with ONE-Dyas' two-well development drilling program offshore the Netherlands, are close to being awarded.

Meanwhile, one campaign is now being pushed into 2025 with the potential for two more to also be deferred.

There is only one unit that has free and clear availability from late first quarter 2024. However, the unit is allegedly a frontrunner for one of the outstanding 2024 requirements. Should extension declarations not materialize, or no new work get secured, a further seven units could become available but, for the most part, not until the second half of 2024.

RigLogix records one tender for work in 2025 (yet-to-be-awarded) and a total of 16 prospects that could equate to just shy of 12 rig years.

Demand covers all types of activity: exploration (135 days), appraisal (225 days), development drilling (2,147 days), CCS (140 days) and P&A (1,699 days).

A Flat Near-Term Outlook in 2024

North Sea jack-up utilization is showing strength once again, however this is largely due to supply leaving the market rather than a recovery in demand. The outlook for the year ahead looks somewhat flat but there is still time for new demand with a 2024 start date to come to the fore.

Drilling contractors, though keen to keep their harsh-environment units in the region, will undoubtedly be considering moving more rigs elsewhere if the contract term and economics make sense to do so.

However, if further rigs leave for multi-year campaigns elsewhere there may not be enough capacity to fulfil some of the longer-term CCS and P&A campaigns, which could come to fruition from 2025 onwards.

Subsequently, the tightened supply and demand balance could result in a smaller pool of rigs to choose from and higher dayrates that could result in some of these campaigns becoming uneconomical.