Portfolio investors have started to rebuild bullish positions in the oil market, reassessing earlier fears about the likely impact of the Omicron variant of coronavirus on major economies and passenger aviation in 2022.Hedge funds and other money managers purchased the equivalent of 54 million barrels in the six most important petroleum futures and options contracts in the week to Dec. 28.Funds have purchased a total of 70 million barrels over the two most recent weeks…

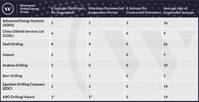

While challenges linger from the 2025 offshore rig market, there are signs it will look brighter from late 2026 onwards.Main Events of 2025One of the biggest talking points of 2024 and 2025 was Saudi Aramco’s suspension of 36 jackups from April 2024…

Throughout 2025 we have seen the subsea vessel market transitioning from a period of record highs towards a more cautious, but still fundamentally strong, outlook. While short-term activity and rates have softened in the latter part of the year…

A new report from Wood Mackenzie, 'Trading cases: Tariff scenarios for taxing times', presents three futures for the global energy landscape, highlighting the far-reaching implications of ongoing trade tensions for the energy and natural resources sectors…

Noble Corporation’s recent decision to sell the Pacific Meltem and Pacific Scirocco for non-drilling purposes highlights a key issue in the drillship market: What happens to cold-stacked rigs that are unlikely to return to work? With the floater…

After what we would argue has been an incredibly eventful 2024 with massive deals, tremendous dayrate developments, further charterer backlog build, and the first series of newbuild orders in years, now comes the time when we turn our gaze towards 2025…

Saudi Aramco’s ambitious post-Covid jackup fleet expansion program, in which the operator looked to increase its fleet size from approximately 49 jackups in June 2022 to 90 in just two years, seemed a daring feat. But fast forward to March 2024…

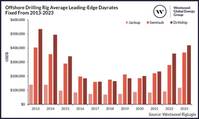

The price to rent an offshore rig hit a nine-year high last year with jackups, semisubmersibles and drillships costing on average $118,000, $368,000 and $419,000, respectively (as of 31 December 2023). These figures represent an overall 54% increase in dayrates when compared with 2021…

Global jack-up marketed utilization has been on an upward trajectory since 2017, reaching its peak of 94% at the end of 2023. However, the outlook for the year ahead looks somewhat flat, though there is still time for new demand.The North Sea jack-up market has improved year-on-year since 2017…

U.S. natural gas futures held near a 21-month low on Tuesday, keeping the contract on track for its second-biggest monthly drop in history, as a decline in output from this week's extreme cold offset forecasts for warmer weather and less heating demand next week than previously expected…

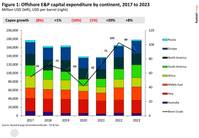

Offshore exploration and production (E&P) capital expenditures (capex) will shake off the pandemic-induced declines of the past two years and rebound by 20% in 2022, reaching a total $165 billion spent on exploration, wells, and facilities (Figure 1)…

Oil prices slipped on Friday after two days of gains and are heading for weekly losses as a strong dollar and worries about a global economic slowdown weigh.Brent crude futures were down 97 cents, or 1%, at $95.62 a barrel by 0826 GMT. U.S. West Texas Intermediate crude was at $89…

Oil rose on Friday, supported by supply tightness and new sanctions on Iran, but prices were on track for a weekly decline amid interest rate hikes from major central banks that fuelled worries about a sharp economic slowdown.Brent crude was up $1…

U.S. natural gas futures edged up about 2% on Tuesday on record power demand in Texas, forecasts for more gas demand over the next two weeks than previously expected, a reduction in gas output, low wind power and much higher global gas prices…

After many false starts, the U.S. offshore wind market is building strong roots for a solid future. But as the market develops from its current northeast and mid-Atlantic niche new opportunities and challenges arise.The U.S. offshore wind market…