Saudi Aramco’s ambitious post-Covid jackup fleet expansion program, in which the operator looked to increase its fleet size from approximately 49 jackups in June 2022 to 90 in just two years, seemed a daring feat. But fast forward to March 2024 and the Saudi Arabian National Oil Company (NOC) almost met its target having 89 jackups at work.

To reach this target, the operator awarded 247.8 years of contract backlog during the period January 2022 to December 2023, with the majority of awards being three-to-five-year deals, and some even as long as a decade.

The Middle Eastern operator took supply from all over the world, which meant not only Middle Eastern jackup utilization increased, but so too did the global figure – jumping from 83% marketed committed utilization in January 2021 to 94% by December 2023.

However, in January 2024 Saudi Arabia ordered Saudi Aramco to halt its oil expansion plan and to target a maximum sustained production capacity of 12 million barrels per day (bpd), 1 million bpd below a target announced back in 2020.

Initially it was unclear if the NOC would cut any offshore rig capacity, but following multiple industry rumors, in early April the confirmation of various suspensions started rolling in, finally equating to 22 jackups across eight contractors to date.

Although the full terms and conditions of each suspension have not been disclosed, it is understood that the majority will be for up to one year apiece and at US$0 day rate (or another mutually agreed standby rate). The original term of the suspended contracts will automatically be extended for a period equal to the suspension for each rig, preserving the remaining backlog, while the drilling contractors can also market the rig for other work during the suspension or to terminate the remainder of the contract.

Eight Affected Rig Managers

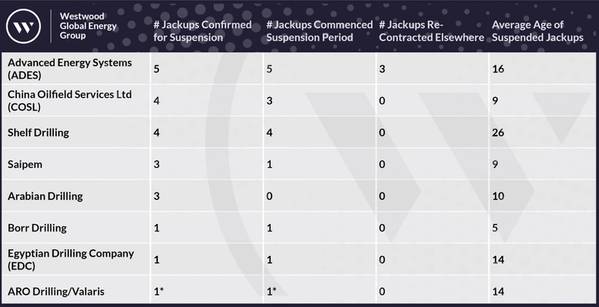

Advanced Energy Systems (ADES), which provides the operator with its largest fix of jackups at 33 units in total was informed five would be suspended. China Oilfield Services Ltd (COSL) and Shelf Drilling will have 44% of their fleet on hire with the operator suspended (four units apiece out of nine). Saipem, which has seven rigs contracted to the operator, will see three units suspended, and Arabian Drilling with nine rigs on hire will also have three units idled. The three remaining companies – Borr Drilling, Egyptian Drilling Company (EDC) and ARO Drilling – were notified of one suspension each.

All these jackups have since begun their suspension periods, with the exception of one Saipem rig and two Arabian Drilling units that were still out working as of 29 May. Working utilization of the Saudi Aramco jackup fleet has fallen from 97.7% in March to just 82.1%, with this anticipated to hit 77% by June/July when the remaining rigs start their suspensions. Globally, marketed working utilisation fell from 86.1% to 83.7% in just two months (March-May 2024).

Furthermore, ARO Drilling-managed/Valaris-owned jackup Valaris 143, which only had approximately seven months remaining on its contract with Saudi Aramco, had its deal terminated by the rig manager. Upon dissolution of the contract, the bareboat charter agreement between Valaris and ARO was also terminated, and the rig was subsequently returned to Valaris.

Re-Contracting Confidence

However, it is not all doom and gloom. Of the remaining suspended jackups, three of the ADES rigs have already since been re-contracted for work outside of the region – one for work in Qatar, one for Egypt and another for operations off Thailand.

There appears to be confidence from most of the remaining affected rig managers about securing new deals. Borr Drilling, in its latest financial update, stated that it expects its one suspended jackup – Arabia I – to be redeployed in a different region before the end of 3Q 2024. Valaris also stated that it is already in talks with new operators for the Valaris 143.

Shelf Drilling, meanwhile, believes it can secure work for three of its four suspended rigs, getting them back into operation before the end of 2024 at attractive dayrates and margin levels. The fourth unit, it believes, could also find new work next year.

COSL has yet to decide if it will relocate any of its four suspended rigs and has not divulged what it’s plans will be, while Arabian Drilling has indicated that it is actively exploring opportunities to redeploy the units with other operators.

Saipem, meanwhile, has revealed that one of its suspended jackups was already budgeted to complete its contract around the middle of this year and will be delivered back to the owner. Another unit will undertake planned maintenance and recertification during the suspension period, and the third will most likely be redeployed into a different geographical area substituting another rented unit that will be subsequently delivered back to the owner. Opportunities for Redeployment.

Opportunities for Redeployment.

So where could these rigs potentially end up, should their managers choose to bid them elsewhere? RigLogix records a total of 32 requirements at a full tender or direct negotiation stage, that are due to begin in the next year should they move ahead.

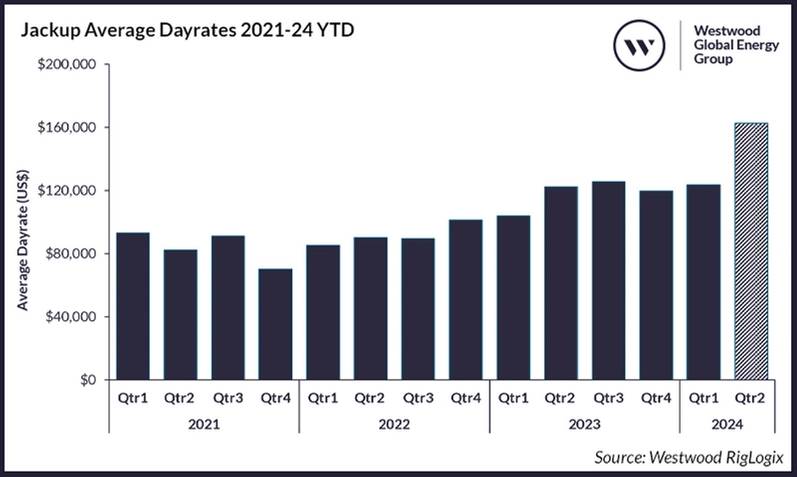

India, Southeast Asia and Africa appear to be offering up the lion’s share of potential demand days during this period. However, some rumours suggest that due to this new additional supply of jackup capacity in the market, we may see some operators that currently have active tenders out in the market look to cancel and re-tender as they may potentially be offered lower dayrates in the current environment. The upward trajectory of dayrates appears to be unaffected year-to-date.

Total remaining term on the suspended contracts comes to approximately 54 years of backlog, or 66 years including options. Of course, some of this has now been terminated and perhaps more will be in the future. It is unclear if those rigs that have been re-contracted outside of the region will return to finish their stints with the Saudi Arabian operator after their new commitments.